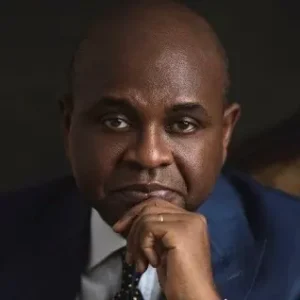

Each time a Nigerian considers how much burden they bear to live in the nation, they wonder if improving the economy is a rocket science. Well, a former deputy governor of the Central Bank of Nigeria, Kingsley Moghalu, know better and he has something to share.

He says he knows why the Nigerian economy is struggling.

Moghalu predicted that the road ahead for Nigeria would be rocky partly because the people don’t want change.

Mr. Moghalu identifies Nigeria’s recent economic issues to include inflation, electricity tariff hikes, exchange rate volatility and naira value depreciation.

He identified the issues while addressing a group of 20 global institutional investors about the state of the Nigerian economy.

Some of the investors were from the US and European asset management firms, valued at over $15 trillion.

It was a gathering at the Annual Spring meeting of the International Monetary Fund (IMF) and World Bank held in Washington DC.

Have You Read: Predictions: Nigeria’s Economy To Grow By 3.7% In 2025 -World Bank

Necessary Reforms

According to Moghalu, the CEO of Sogato Strategies LLC, the current economic reforms are necessary, but government must manage the fallouts better.

He described the reforms as painful but necessary, stressing that they were needed to stabilise the economy as global investors are watching closely.

The former CBN deputy governor argued that investors’ sentiment was shifting from negative to a cautious, wait-and-see mode.

This stance, he said, has been influenced mainly by the policy steps taken by the CBN in recent weeks and months.

“However, Nigeria’s external reserves have remained under pressure. If this trend continues, it will become a risk factor for the sustainability of exchange rate stability.

“Much depends on whether more forex income will be earned from increased oil production and exports.

“We hope that Dangote Refinery can positively impact the forex exchange pressures,” he maintained.

The economist also reviewed the inflation trends, monetary policy prospects, and the selective removal of subsidies on electricity tariffs.

He projected that inflationary pressures would remain elevated over the next two years despite the best efforts of the CBN.

This projection is based on a combination of security challenges and their impact on food supply.

He said that low electricity generation and distribution will continue to affect the Nigerian economy and projections for future growth.

“Economic productivity will not improve if a transformation does not occur in the power sector.

Subsidy Trinity

Also, the event focused on the “subsidy trinity” of fuel, currency, and electricity subsidies that have been the cornerstone of Nigeria’s reform agenda.

You May Also Like: Untold Reasons Nigeria’s Economy Is Failing

Also, the global investors and Moghalu discussed his briefing in a question-and-answer session under Chatham House rules (that is, without attribution of views expressed or questions asked and answered to specific participants).

It was agreed that caution still reigned regarding the possibility of an immediate return of large-scale capital inflows into Nigeria.