Fintech companies; Kuda, Palmpay, Opay, Moniepoint have been banned by the central bank of Nigeria (CBN) from onboarding new customers.

“We’ve temporarily paused new signups on our platform.

“This means that you’ll be unable to open a new account at the moment.

“We apologise for any inconvenience this may cause,” read a notice on the website of one of the Fintech banks affected.

This directive came from a CBN two days after the EFCC blocked 1,146 bank accounts involved in unauthorised forex dealings.

Meanwhile, the Bank Customers Association of Nigeria says is it is behind the CBN on this directive.

The CBN’s move was linked to an ongoing audit of the Know-Your-Customer process of the Fintechs.

Fintech Companies Under Scrutiny

The Fintech companies have been under scrutiny in recent months over concerns around money laundering and terrorism financing.

It was gathered that the CBN had summoned some of the heads of Fintech companies to Abuja to discuss issues around KYC last week.

At the time of this report, IbrandTv could not open new accounts on one of the affected fintech apps.

However, customer deposits and banking activities are not affected.

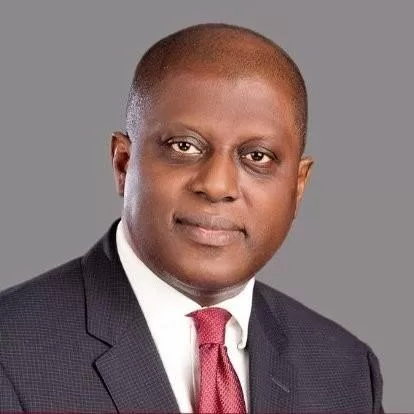

The President of the Bank Customers Association of Nigeria, Uju Ogubunka, backed the CBN’s move to suspend new account opening on the affected platforms.

CBN Made The Right Move?

He mentioned that the strict regulations that govern deposit money banks must apply to Fintechs, and microfinance banks in order to ensure the integrity of the financial institutions.

Uju said, “Anything that can disrupt the system should not be permitted.

“If the platforms are being used for things that are against the regulations, I think the CBN’s decision is OK.

“I don’t see anything wrong with that. It behoves on the companies now to get their KYC right.

“Let them do what they are supposed to do. KYC applies to banks and other financial institutions that deposit money.

Also Read: See Names Of 16 CBN-Licensed Loan App Companies In Nigeria

“It should also apply to them so that the regulators can understand what is going on and hold them accountable.”

See New Directive Tinubu Gives To EFCC Over Internet Crimes