Figures obtained from the CBN on Monday on the movement of foreign reserves showed that the reserves, which stood at $37.21bn as of January 18, fell to $36.79bn as of the end of February 16, 2023.

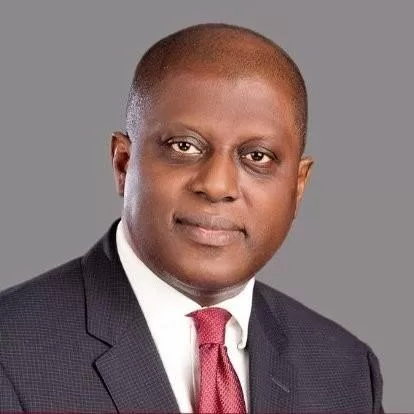

The CBN Governor, Godwin Emefiele, last year announced plans to redesign the naira notes, so as to mop up currency outside the bank vaults.

Urging Nigerians to take advantage of alternative payment channels, Emefiele, said this would drive the digital payment systems in the country.

Unfortunately the policy, however, brought untold hardship to Nigerians and has stirred up protests across cities.

To lower the effect, President Muhammadu Buhari directed that the old 200 Naira note should be re-circulated.

He said it would remain legal tender until April 10, 2023, while the 1000 and 500 Naira notes seized to be valid for transactions in the country, as earlier announced by the CBN.

Deposit Money Banks have also commenced the collection of old 500 and 1,000 Naira notes, even without giving the depositors new naira notes in return.

Also Read: Black Market: Dollar To Naira Exchange Rate

The hardship occasioned by the scarcity has continued to trigger tension among aggrieved citizens.

The CBN Governor, Emefiele, had in 2022, launched the ‘RT200 FX Programme’ to boost forex supply in Nigeria through the non-oil sector in the next three to five years.

“The RT200 FX Programme is a set of policies, plans, and programmes for non-oil exports that will enable us to attain our lofty yet attainable goal of $200bn in FX repatriation, exclusively from non-oil exports, over the next three to five years,” he said.