While Godwin Emefiele will be thinking of how to come off the allegations against him, Mr. Folashodun Adebisi Shonubi is stepping in as the Acting Governor of the Central Bank.

This June is Godwin Emefiele’s 9th year in office. Sadly, all that started well does not seem to be ending well for the Delta State man.

Emefiele is stripped of his title as the Governor of the Central Bank, with his name imprinted in the black book of the government for financial misconduct.

President Bola Tinubu had issued a directive to Mr. Emefiele to hand over to Mr Shonubi who was a Deputy Governor of the Central Bank.

Also, he is on suspension until after investigation proves him innocent.

Emefiele was in charge of the CBN for 9 years, beginning June 2014.

President Tinubu forwarded the suspension order to the former boss of the apex bank on Friday.

While he steps aside Shonubi, who was the Deputy Governor, Operations Directorate, takes over in acting capacity.

In a tweet, an aide to the President, Bayo Onanuga, said that Emefiele had been arrested.

Also Read: Just In: President Tinubu Suspends CBN Governor Emefiele

According to him, the former CBN governor was picked up by the DSS.

This development signals the commencement of the investigation of Mr. Emefiele.

See Tweet.

Folashodun Adebisi Shonubi is the CBN acting governor. He has been since October 2018, the Deputy Governor, Operations Directorate. He was born on the 7th of March, 1962. He attended the University of Lagos from 1978 to 1983 and obtained a Bachelor of Science in Mechanical… https://t.co/mF6UeMmA2b

— Bayo onanuga (@aonanuga1956) June 9, 2023

Emefiele’s allegation may be bordering on the Naira redesign policy of the Central Bank.

The policy, which was for pushing the apex bank’s cashless policy, did not live up to expectation.

In fact, it caused more pain and left big scars on banks and individual business owners.

The Cashless Disaster

This is because the redesign of the Naira resulted in the scarcity of Naira notes, making small business holders the burden bearers in a nation notable for poor government administrations.

Now, many Nigerians say that cashless policy implementation was a disaster.

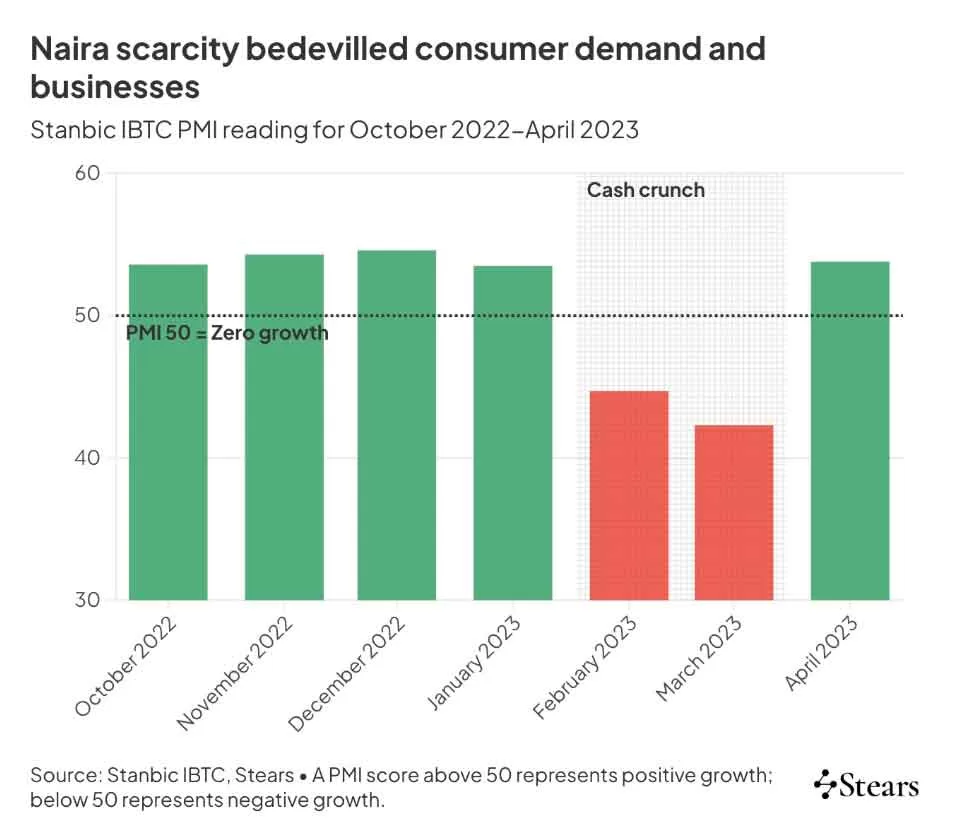

From the image below, Emefiele’s policy dealt Nigeria’s economy a big blow that Tinubu had come to inherit.

Basically, that policy has made the job of President Tinubu even tougher.

Basically, that policy has made the job of President Tinubu even tougher.

Sadly, the economy is near recession, going by the World Bank’s recent projections.

Also Read: Economic Growth In Nigeria Continues To Weaken – World Bank

There are lots of businesses that could not make it through the Naira scarcity era.

Unfailingly, the current administration of President Tinubu is carrying the burden of that collateral damage also.

Meanwhile, probing into the cashless policy issue could uncover why the Central Bank ignored the consequences it could have; like the one in the video below.

A woman told a story of how Emefiele’s cashless policy made her see her begging side.