You see, when things are going south and you are appointed into office to stabilise things, people want to see that you are moving swiftly.

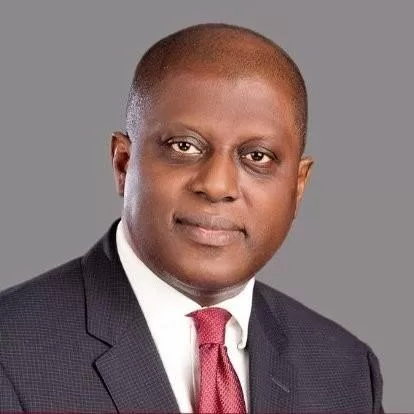

But Olayemi Cardoso was a little bit too slow for Nigerians. As a result, some Nigerians nurse the opinion that he was a square peg in a round hole.

He is the Governor of the Central Bank of Nigeria and people think he gave Nigerians a reason to doubt his capabilities.

At the moment he seems to have picked up pace with efforts in place to tighten monetary policy measures.

Could these moves mean that he is the right man for the job?

Many are the challenges facing Nigeria, but with consistent positive and progressive policies, we will overcome.

After a careful study of the inflation rate and exchange rate challenges affecting the health of the nation’s economy, the governor of the Central Bank of Nigeria (CBN) Olayemi Cardoso is on a race to tame it with proactive policy measures.

Have You Read: Hardship: Want To Create Wealth? See CBN’s Recommendation

To achieve this, the Monetary Policy Committee (MPC) of the Central Bank of Nigeria will have to meet.

They will be meeting to further determine how to improve the value of the local currency.

Also, efforts will be channeled towards making taming inflation.

To this effect, the CBN published a notice of MPC meeting on Tuesday. The meeting will hold on Monday, March 25 and Tuesday March 26.

CBN’s MPC Will Meet Next Week

A notice published on the CBN website reads: “The 294th meeting of the Monetary Policy Committee (MPC) is scheduled to hold on March 25 and 26, 2024″.

The first MPC meeting under Olayemi Cardoso, as CBN governor, held on February 26 and 27, 2024.

At that meeting the MPR was raised by 400 basis points to 22.75 from 18.75%

The asymmetric corridor around the MPR was adjusted to +100/-700 from +100/-300 basis points.

Furthermore, it raised the Cash Reserve Ratio (CRR) from 32.5% to 45.0% and retained the Liquidity Ratio at 30%.

“Given the imperative to curb inflationary pressures, which could pose social challenges and impede long-term growth prospects.”

You May Also Like:Financial Literacy: CBN Sensitises Students On Savings Culture

“I am persuaded that the MPC must tighten monetary policy measures, with a medium-term inflation target of 21.40% by the end of 2024 in mind,” Cardoso said.

According to National Bureau of Statistics (NBS), headline inflation rose to 31.70% in February 2024, from 29.90% in January 2024.