The Nigerian Stock Market extended its winning streak on Tuesday.

Investors felt pleased as their portfolios swelled by ₦271 billion.

The Nigerian Exchange Limited (NGX) saw a surge in market capitalisation on Tuesday, climbing from ₦55.166 trillion to ₦55.437 trillion.

This impressive gain of ₦271 billion, or 0.49%, brought renewed optimism to the trading floor.

The All-Share Index mirrored this positive trend, rising by 0.49%, which translated to a 473-point increase.

It closed the day at 96,510.13, up from Monday’s 96,037.28.

A wave of investor enthusiasm for Tier-one banking stocks largely fueled the day’s success.

Major players like Guaranty Trust Holding Company (GTCO), Zenith Bank, FBN Holdings, United Bank for Africa (UBA), and Access Corporation were at the center of this activity.

Their influence drove the Year-To-Date (YTD) return to an impressive 29.07%.

The market showed broad strength, with 49 stocks advancing while only 14 declined.

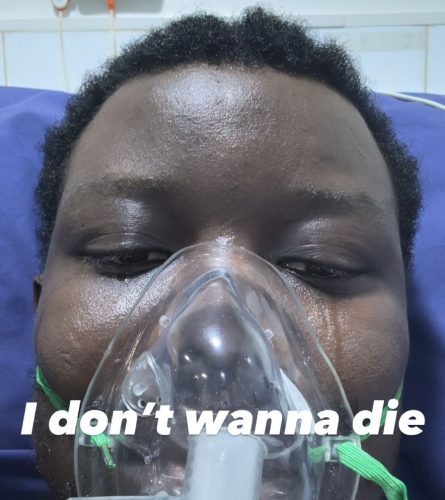

Have You Read: TG Omori: Five Possible Causes Of TG Omori’s Kidney Failure

Gainers And Losers

John Holt, Julius Berger, Neimeth International Pharmaceuticals, and Total Plc led the charge among the gainers, each soaring by 10%.

By the end of the day, their share prices stood at ₦3.08, ₦143, ₦2.20, and ₦619.30, respectively.

Not far behind was Skye Shelter Fund (SFSREIT), which rose by 9.99% to close at ₦134.90 per share.

However, not all stocks shared in the day’s success.

UPL found itself at the top of the losers’ list, suffering a 9.58% decline to close at ₦2.17.

Close behind was Cutix Plc, which fell by 6.25% to ₦3 per share.

Vitafoam dropped by 5.17% to ₦18.35, while Transnational Corporation slid by 5.08 percent to ₦11.20.

Linkage Assurance ended the day down 5%, closing at 0.95k per share.

A surge in trading activity marked the day.

Turnover shot up by 45.08% compared to the previous session.

A total of 443.16 million shares changed hands, valued at ₦5.64 billion.

This was a notable increase from the previous day’s 390.51 million shares worth ₦3.88 billion.

However, the number of deals decreased slightly to 8,493 from 9,242.

Leading the pack in trading volume was Veritas Kapital, with an impressive 83.08 million shares traded.

Meanwhile, Access Corporation dominated in value terms, with transactions totaling a hefty ₦1.06 billion.

Tuesday’s market performance highlighted the continued confidence in the Nigerian Stock Market.

Banking stocks played a key role in driving growth and investor gains.