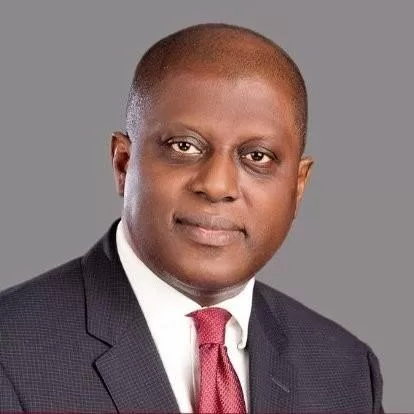

The Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, has disclosed that the Nigerian payment system recorded significant achievements with the introduction of the cashless policy in 2012.

Emefiele revealed this while addressing members of the Green chambers on CBN’s implementation of the cashless policy and new withdrawal limits.

The CBN governor was represented at the hearing by the Deputy Governor of the Financial System Stability (FSS) Directorate, Dr. Aisha Ahmad.

Emefiele said Nigeria had been adjudged Africa’s undisputed real-time and digital payments leader, with over 3.7 billion real-time transactions in 2021 following the successes achieved in the payment system.

According to him the adoption of electronic banking had significantly increased among the Nigerian populace while the cashless policy had further spurred policy innovation that had expanded the breadth and depth of financial system participants, transaction channels, and financial access points.

The CBN governor explained to the lawmakers that redesigning the N1, 000, N500, and N200 notes and the nationwide implementation of the cashless policy was intended to further sustain the achievements in the payment system. This was in line with the quest to foster a safe, credible and efficient payment system that would be the pride of all Nigerians and the envy of the world.

He insisted that the cash withdrawal policy was neither targeted at any segment of the society nor intended to disenfranchise hardworking Nigerian citizens and businesses, as insinuated in some quarters.

The House of Representatives, on Thursday, mandated the CBN and commercial banks to put in place measures to prevent the deportation of Nigerian students abroad by ensuring that forex was made available for the payment of their school fees at their various institutions of learning. The resolution of the lawmakers was a sequel to the adoption of a motion sponsored by Hon. Akande Sadipe at the plenary, Thursday.

That was as a coalition of civil society organisations continued to mount pressure on the Department of State Services (DSS) to retract its unverified charges against Emefiele. They maintained that the CBN governor was not a terrorist.

However, Emefiele assured during the hearing in the House that the central bank would continue to monitor the implementation of its monetary policies and be flexible on the limits in response to feedback received.

He said, “We crave the National Assembly’s continued support as the bank continues its implementation of transformational payments and financial industry initiatives in line with its mandate.”

According to him, the CBN’s October 26 pronouncement on the redesigning of some denominations of the naira and its circular of December 6 on the revised cash withdrawal limits and nationwide implementation of the cashless policy had elicited mixed reactions by the public, as keenly noted by the bank.

He said while a segment of Nigerians applauded the policies, others raised concerns, particularly concerning the effect of the policies on the underserved and rural communities in Nigeria.

Justifying the naira redesign policy, Emefiele stressed that it would help control inflation, as the exercise would help mop up currency outside the banking system, thereby ensuring more reliable data on money supply, which will in turn facilitate better monetary policy formulation and effectiveness.

In addition, he said the policy would boost the appreciation of the naira, as the higher denomination and the volume of banknotes outside the banking system used to speculate on the currency would reduce.

Emefiele stated that the naira redesign program would help fight banditry and terrorism, as the large volumes of cash used to pay ransom to bandits/terrorists would be reduced.

He explained, “It will assist in the fight against corruption as the exercise would rein in the higher denominations used for this purpose and the movement of such funds from the banking system could be tracked easily.”

The CBN governor noted, “Despite the dominance of highly advanced payment systems, many countries carried out currency redesign to remain ahead of counterfeiters, ensure durability, fight corruption, and reduce the cost of currency management, among other reasons.

“It is against the backdrop of the foregoing that the CBN, in line with its statutory powers as enshrined in Section 2(b) and 19 of the CBN Act 2007, sought and obtained the approval of Mr. President to redesign and issue new series of naira notes in the N200, N500, and N1000 denominations.”

Commenting on the revised cash withdrawal limits, Emefiele noted that the CBN was not unmindful of the concerns raised in response to the new cash withdrawal policy and remained flexible to make the necessary adjustments to ensure wider public acceptance of the policy.

He said, “Consequently, we have reviewed the cash withdrawal limits upwards to N500,000 weekly for individuals (from N100,000) and N5,000,000 weekly for corporates (from N500,000). Furthermore, the applicable charges above the limit have been reduced to three percent and five percent, respectively.

“Mobile money agents who provide cash-in cash-out services in rural areas have also been recognised and provided for in the revised guidelines.”

Further justifying the cashless policy, Emefiele pointed out that the CBN carried out an in-depth analysis of over-the-counter intra-bank cash transactions over 12 months (November 2021- October 2022) to assess the impact of the policy on the generality of citizens.

He said the outcome showed that a significant volume of cash transactions was below the maximum thresholds indicated under the extant cashless policy and was, thus, not subject to the cash processing charges.

He added, “It is worthy to note that 94.04 percent and 62.63 percent, respectively, of volume and value of cash transactions by individuals, were below the threshold while 82.36 percent and 39.38 percent of the volume and value of cash transactions by corporates was below the threshold.

“Transactions at agent locations are also below the thresholds. For instance, 99 percent of cash withdrawals at agent locations are below N300, 000, average cash out transaction size per individual is N18, 000, whilst average cash withdrawals by agents are between N1, 000,000 and N2, 150,000.”

According to him, “The proliferation of financial access touch points and e-payment channels across urban and rural areas, which presents citizens with ample alternative for financial transactions further justifies the nationwide implementation o the policy.”

Emefiele said there were 6,500 branches of deposit money banks, and OFIs, 1.4 million agent locations, 900,000 POS, and 14,000 ATMs, including 31 commercial banks with 4,603 branches; 878 MFBs with1,966 branches; 1.4 million agents; 899,642 PoS Terminals and over 14,000 nationwide.

According to him, it is in the public interest to promote an efficient payment system via the cashless policy, which helps reduce the punitive costs of cash processing, often passed on to bank customers.

Emefiele added, “It is instructive to note that the implementation of the cashless policy in six states resulted in a reduction in the cost of currency management by 15.20 percent, from N36.97 billion to N31.35 billion between 2013 and 2014.

“The trend, however, reversed in 2014 following the suspension of cash deposit charges in the six states currency handing cost increasing by 17.20 percent between 2014 and 2015 following the suspension.”

The CBN governor also said the cost of currency management had been on the increase, reaching N47.25 billion between January and October 2022.

Among other things, he said the CBN cashless policy was in line with the bank’s quest to adopt international best practices and international conventions, especially given recent reputational damage with some Nigerians perpetuating advance fee fraud.

He added that the CBN’s mandates and responsibilities under the CBN Act 2007 as amended empowered it to promote a sound and stable financial system and credible efficient payment system- Section 2d, Section 47 of the CBN Act and the policies were issued under these legal provisions, adding that actions are well within its mandate.

He said, “It is also important to note that extensive engagement continues across multiple stakeholders since the cashless policy was first launched in 2012. By January 2023, the initiative will be entering its 11th year and stakeholders would have been adequately enlightened. The initial go-live date for its implementation nationwide was 2015.”

On the misconceptions about the cashless policy, Emefiele told the lawmakers that there were many fallacies about the naira redesign and cashless policy, which needed to be resolved.

He said currency denominations of N5, N10, N20, N50, and N100 remained legal tender and were unaffected by the naira redesign policy. The denominations were available for use across the country, including at markets in rural areas and the informal sector of the economy, while there were currently no processing fees applied to cash deposits, he stated.

He stressed that unlimited amounts could be deposited without charge, to enable seamless and unrestricted deposit of any notes affected by the currency redesign.

The CBN governor said, “The processing fees on cash withdrawals are not new, as these have been in place in Lagos, since 2012, and in the five other cash-less states and FCT, since July 2013.