US equity-index futures gained on Thursday as technology shares rallied on the penultimate trading day of what’s been a brutal year for financial markets.

Contracts on the tech-heavy Nasdaq 100 rose more than 0.6% following gains for Asian technology stocks earlier amid signs China is easing a regulatory crackdown. Contracts on the S&P 500 were up about 0.3%.

Tesla Inc. climbed more than 3% in premarket trading, with tech giants including Amazon.com Inc. and Netflix Inc. also among the biggest gainers. Treasuries were steady and a gauge of the dollar declined.

The tech rally was a small ray of light as the year draws to a close with investors again focused on risks arising from the spread of Covid-19. The US said it would require inbound airline passengers from China to show a negative Covid-19 test prior to entry. In Italy, health officials said they would test arrivals from China after almost half of the passengers on two flights from China to Milan were found to have the virus.

Hong Kong removed limits on gatherings and testing for travelers in a further unwinding of its last major Covid rules, offering a boost to the global economy but sparking concerns it would amplify inflation pressures and prompt US policymakers to maintain tight monetary settings.

“Investors are going into 2023 with a cautious mindset, prepared for more rate hikes, and expecting recessions around the globe,” said Craig Erlam, a senior market analyst at Oanda Europe Ltd. “And then there’s China and its u-turn on Covid prevention. It’s been quite the shift from fighting every case to living with the virus and that creates enormous uncertainty for the start of the year.”

The Stoxx Europe 600 index erased losses to trade little changed, with gains for technology stocks offsetting declines for retail and consumer-focused shares.

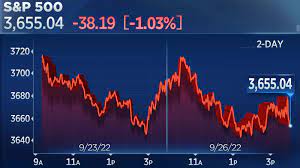

Global equities have lost a fifth of their value in 2022, the largest decline since 2008 on an annual basis, and an index of global bonds has slumped 16% amid sticky inflation and rising interest rates.

Data released Wednesday showed the Federal Reserve’s aggressive tightening policy has taken a toll on the housing market. US pending home sales fell for a sixth consecutive month in November to the second-lowest on record. Borrowing costs have roughly doubled since the start of the year and home sales have been declining for months.

Elsewhere in markets, oil dipped amid thin liquidity as investors weighed the fallout from a Russian ban on exports to buyers that adhere to a price cap.

Stocks

The Stoxx Europe 600 fell by 0.1%

S&P 500 futures rose 0.3%

Nasdaq 100 futures rose 0.6%

Futures on the Dow Jones Industrial Average rose 0.1%

The MSCI Asia Pacific Index fell 0.6%

The MSCI Emerging Markets Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.2% to $1.0638

The Japanese yen rose 0.6% to 133.62 per dollar

The offshore yuan rose 0.3% to 6.9768 per dollar

The British pound rose 0.2% to $1.2044

Cryptocurrencies

Bitcoin rose 0.3% to $16,562.7

Ether rose 0.6% to $1,193.89

Bonds

The yield on 10-year Treasuries declined three basis points to 3.85%

Germany’s 10-year yield declined two basis points to 2.48%

Britain’s 10-year yield advanced three basis points to 3.69%

Commodities

Brent crude fell 2.1% to $81.47 a barrel

Spot gold rose 0.4% to $1,810.81 an ounce