Amidst circulating information that cash in circulation is gradually rising the United Bank for Africa is making a profit.

The latest result released by the Bank speaks to this information, as has been made available.

United Bank for Africa Plc (UBA) has released its financial results for the first quarter ended March 31st, 2024.

Have You Read: Stop Hoarding Excess Foreign Currency For Profit -CBN

The result showed impressive growth, saying that the Gross Earnings rose by 110% across key performance measures.

UBA’s Gross Earning Hit ₦570.2bn

Gross earnings rose from ₦271.1billion to ₦570.2 billion while Interest Income grew by 130%, to ₦440.7 billion.

Operating Income increased by 115%, from ₦175.7 billion in 2023 to ₦378.59 billion.

UBA’s profit was released to the Nigerian Exchange Limited (NGX) on Friday, May 3, 2024.

In the Group’s 2023 Full Year Audited Financials, UBA’s profit before tax rose to ₦156.34 billion in Q1 2024.

Profit After Tax jumped from ₦53.5 billion to ₦142.5 billion, representing an impressive rise of 165% year-on-year.

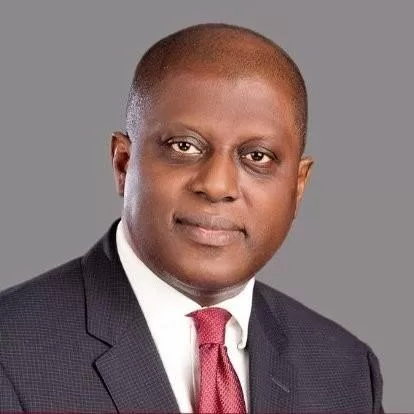

The Group Managing Director of UBA, Oliver Alawuba, said the Group delivered a strong first-quarter performance.

He said: “Our record Q1 profit before tax was delivered with triple-digit gross earnings growth, supported by interest and non-interest income.

“Fees and Commissions rose by 118% year-on-year on the back of improved efficiencies and continued digital adoption.

“This has improved efficiency and customer satisfaction, with the Group’s cost-to-income ratio held at 57.8%.

“The Group’s balance sheet grew steadily with Total Assets increasing by 23% to ₦25.4 trillion.

“Customer deposits closed at ₦18.4 trillion, recording a 23% increase year-on-year, largely attributed to growth in current accounts and savings accounts.

You May Also Like: Stop Hoarding Excess Foreign Currency For Profit -CBN

“Our unwavering commitment to sound governance, robust risk management, and financial strength positions us for continued growth, while we contribute meaningfully to inclusive economic development across our network”.

Also, the UBA’s Executive Director, Finance and Risk, Ugo Nwaghodoh, said actions taken to enhance the Group’s performance continued to deliver.