In the face the current Naira crunch and banking predicament, Access Holdings Plc has pumped in $300 million into Access Bank Plc.

The $300 million injected into the bank is a capital investment for expansion that will help to boost Access Bank Plc expansion across Africa.

In a regulatory filing at the Nigerian Exchange (NGX) on Tuesday, Access Holdings stated that the new capital investment will supplement the capital needs of the bank’s African expansion strategy.

The company noted that over the years, Access Bank had made significant strides towards attaining strong market presence in the key trade and payments corridors across the African continent.

The new investment was in the form of a Tier 1 capital qualifying mandatory convertible instrument and is expected to improve the bank’s shareholders funds and total capital ratios.

The Central Bank of Nigeria (CBN) has approved the investment.

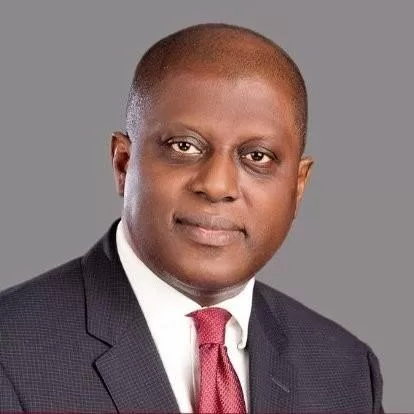

The Group Chief Executive, Access Holdings, Dr Herbert Wigwe, said that, as a leading financial institution in the continent, the group remain foresighted in its approach to its growth and capitalisation needs.

“This investment is a capstone initiative following the $500 million Additional Tier 1 capital raised by the bank in 2021 and advances its vision to be the world’s most respected African bank.

“Access Holdings benefits from this non-dilutive approach to raising growth capital, as we continue to invest in initiatives geared towards delivering our vision”

According to him, the bank wants to build a globally connected community and ecosystem inspired by Africa for the world through disciplined growth and diversification.