It appears the charges for Unstructured Supplementary Service (USSD) that banks post to your accounts with them are just sitting with the banks and never get to the telecommunication companies.

Now, Telecommunications Companies (telcos) in Nigeria have been forced to take a decision that will hurt you, all the financially excluded, vulnerable, and critical masses in Nigeria.

Why? you may ask.

The Nigerian banks for some years now have been indebted to telcos. That indebtedness has now reached ₦120 million. This is a service that has been rendered.

Read Also: Debt Servicing: Nigeria Spends $112.35m Monthly -CBN

This long standing situation has developed into a serious feud between telcos and Nigerian banks.

What Is The Debt About

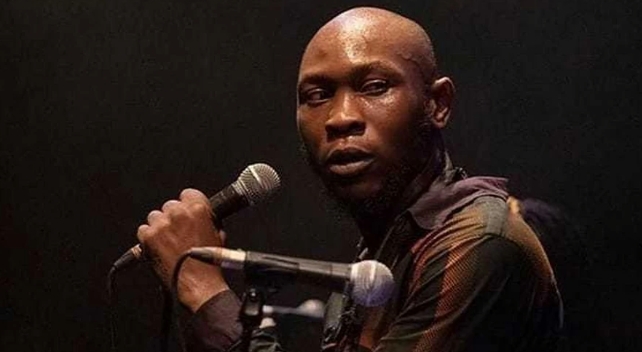

According Association of Licensed Telecommunications Operators Chairman of Nigeria (ALTON), Gbenga Adebayo, the ₦120 million debt is for services provided through Unstructured Supplementary Service (USSD).

While the dispute still lingers, telcos have received the go-ahead from the Nigerian Communications Commission (NCC) to disconnect the banks for refusing to pay their debt.

Sadly, this is not the first time this is happening.

A few years ago, the NCC, the Central Bank of Nigeria and the Minister of Communications intervened in the issue.

Once in 2020, when the debt was ₦42 billion and then in 2022 when it rose to ₦80 billion.

CBN’s Intervention

In an effort to resolve the long standing dispute, the CBN’s Director of Corporate Communications, Isa Abdulmumin, explained that the CBN was aware of the dispute between the two sectors.

The CBN had said that efforts were, however, being made to resolve the dispute in earnest, as it might have a negative impact on customers if the dispute lingers further.

He said the CBN, remains committed to ensuring that the areas of contention related to the collection of telco charges for USSD are resolved in the interest of the financial system and the overall economy.

Clarify What Constitutes USSD Charges

Furthermore, Isa appealed to both parties to clarify what amounts to a successful transaction and the amount to be charged by them.

According to him the issue is largely technical and bordering on pricing.

He said: “Indeed, it was due to the direct intervention of the CBN (or CBN Governor) in March 2021.

“The banks and telcos agreed upon a per session price of ₦6.98 (including settling any outstanding fees).

“As far as we know, since 2021, DMBs have continued to collect the USSD fees and remit the same on behalf of the telcos based on that agreement.

“We understand the latest dispute concerns technical issues regarding the definition of a successful transaction from a bank and telco perspective.

You May Also Read: Economy: 4 Reasons Tinubu Will Face Tough Start

“USSD fees are charged by DMBs using an automated system which bills the customer for a successful transaction only after a banking service is consumed.

“For the Telcos, a successful transaction happens once the customer has dialed the USSD short-code, which may not lead to the consummation of banking service.

ALTON chairman, revealed that the outstanding amount currently exceeds ₦120 billion and has been pending for several years.