Before the ‘last date’ of accepting old ₦200, ₦500 and ₦1,000 notes got close, Nigerians rushed to the bank and sacrificed their notes. No one knew it was Naira scarcity we were all walking into.

The fear of losing hard earned money, now brings regret to some persons when they remember that those old notes will still be in circulation till December.

Nigerians are still feeling the pains of Naira scarcity, as they now buy the currency. Each time they do, they could lose as much as 300 Naira to get 1,000 that they need to buy petty things in the market.

After the Central Bank of Nigeria (CBN) removed Naira notes from the system, the new notes it claimed it released are not showing.

Also, when the CBN aligned with the Supreme Court on the extension of the old Naira notes to December 31, people expected more.

At least, they wanted the CBN to speak up on the next move, at least, with a promise. That wait has now ended.

But will the CBN ever release the Naira notes it had mopped up?

Cash Outside Banking System

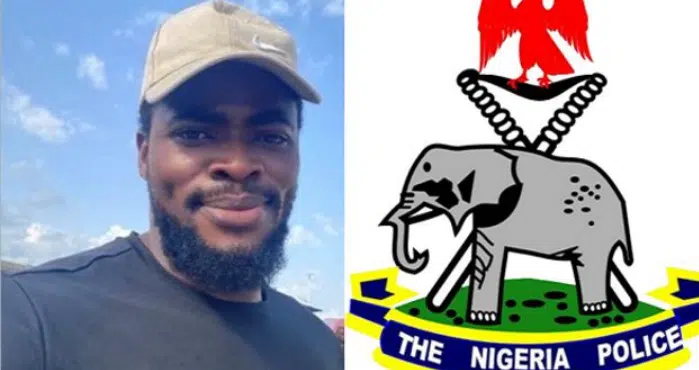

Finally, on Wednesday, during a briefing of Journalists, the CBN boss, Godwin Emefiele, spoke on the supply of money in Nigeria.

He said that the implementation of the Naira redesign policy had resulted in a reduction in currency outside the banks.

Also Read: If Your Transactions Fail, Emefiele Has Something For You

First, he commended fintechs for facilitating smooth transactions for Nigerians by reducing the strain on traditional banks.

He said: “Before the naira redesign, we said that there was about ₦3.23 trillion in circulation out of which only ₦500 billion was held in the banking system and ₦2.73 trillion was outside the banking system”.

That amount has now reduced and the CBN still claims there are Naira notes in circulation.

The Truth

“It was published yesterday (Tuesday) that currency in circulation is close to ₦1 trillion. CBN will continue to pump the newly redesigned currency into the market.

“The truth is that at some point we will need to reassess to know whether the currency in circulation has attained an optimal level so as to put in place measures to ensure that we don’t go back to where we were before where people kept money outside the banking system for their own benefits,” he added.