Since April 2024, the Nigerian banking sector has undergone a significant recapitalisation effort, and investors are already reaping the rewards.

Over the past year, seven banks—Fidelity Bank, GTCO Holdings, Access Holdings, Sterling Bank, FCMB Group, UBA, and Stanbic IBTC Holdings—have collectively raised over ₦1.1 trillion through public offers and rights issues.

As a result, investors are well-positioned to gain substantially once the share allocations are finalised.

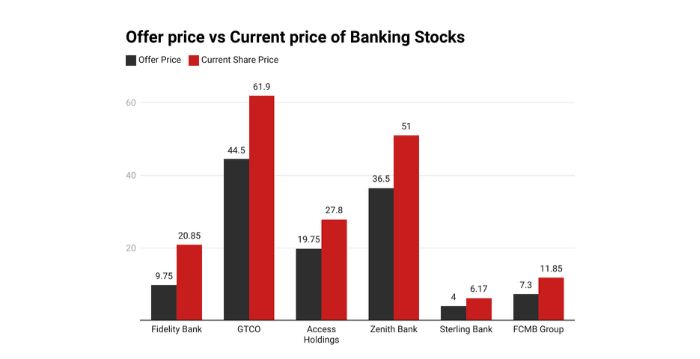

Fidelity Bank raised ₦127.1 billion, with public offer shares priced at ₦9.75 and rights issue shares at ₦9.25.

By January 27, the stock price had increased to ₦20.85, giving investors 114% capital appreciation.

For example, a ₦100,000 investment at the public offer price would now be worth ₦208,500.

GTCO raised ₦209 billion by offering shares at ₦44.50.

By January 27, the stock price had risen by 39%, reaching ₦61.90.

Therefore, a ₦100,000 investment would now be valued at ₦139,000.

Access Holdings issued 17.77 billion new shares in a rights issue priced at ₦19.75.

Read Also; World Bank, AfDB Commit $48bn To Close Africa’s Energy Gap

By January 27, its share price had increased by 41%, reaching ₦27.80.

Zenith Bank’s oversubscribed programme raised ₦350 billion.

The shares were priced at ₦36.50 for the public offer and ₦36 for the rights issue.

As of January 27, the shares had appreciated by 40% and 42%, respectively, reaching ₦51.

FCMB raised ₦147.5 billion with shares priced at ₦7.30.

Today, the stock price has risen to ₦11.85, reflecting a 62% gain.

Similarly, Sterling Bank’s shares, priced at ₦4, have appreciated by 54%, now trading at ₦6.17.

With these recapitalisations, investors are on track to seeing significant capital gains.