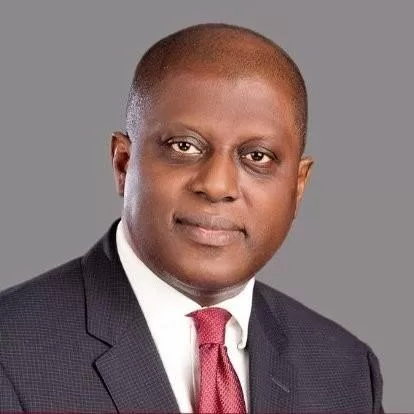

Nigeria’s Central Bank Governor, Olayemi Cardoso, has pledged to stabilise prices and the exchange rate, as the bank raises interest rates for the sixth time to combat rising inflation and strengthen the naira.

Nigeria’s CBN Governor, Olayemi Cardoso, reaffirmed the bank’s commitment to stabilising prices and the exchange rate to combat rising inflation.

After the Monetary Policy Committee (MPC) meeting in Abuja, Cardoso announced that the central bank had raised the benchmark interest rate by 25 basis points to 27.5%, marking the sixth consecutive hike.

As a result, the bank aims to address surging inflation, driven by escalating food and core prices.

The National Bureau of Statistics reported that headline inflation increased to 33.88% in October 2024 from 32.70% in September.

Furthermore, food inflation rose to 39.16%, while core inflation climbed to 28.37%, intensifying pressure on Nigerian households.

Consequently, Cardoso explained, “Members focused on the optimal policy choice to reverse rising prices, stabilise the exchange rate, and anchor inflation expectations”.

Read Also; Commercial Paper Issuance Slows As Interest Rates Climb

However, he acknowledged the ongoing struggle to provide affordable food and energy in Africa’s most populous nation.

Meanwhile, analysts remain optimistic that inflation could ease by the first quarter of 2025, supported by sustained high interest rates and base effects.

In addition, Nigeria’s foreign reserves recorded a slight increase, rising to $40.88 billion in November from $40.06 billion in October.

This improvement could, in turn, strengthen the naira and provide some relief to the foreign exchange market.

In conclusion, Cardoso stated, “Price stability forms the foundation of a thriving Nigerian economy,” as he pledged the central bank’s continued efforts to navigate the nation through its economic challenges and achieve financial stability.