With the rising cases of coronavirus (COVID-19) pandemic and its effect on the world economy, one would blindly conclude that the pandemic affected palm oil production.

The truth is that Palm oil is ‘if not’ the only agricultural product that has not been affected by the ravaging virus to date.

Since the invasion of COVID-19 in Nigeria on February, 28, by an Italian, customers and Marketers have not been seen lamenting a hike in price or scarcity of product, courtesy of Nigeria’s farmers.

In this article, the effect of COVID-19 on Palm oil production, the grassroots experience in Nigeria, Processing of Palm Oil, Formation of Palm Oil, Opportunity to bridge the demand gap, Nigeria’s response to COVID-19 pandemic, CBN intervention, and a Market survey will be discussed in detail.

Emerging positivity from COVID-19 pandemic

For Nigeria as a country to reposition itself in the global ranking, and become a self-sufficient producer of palm oil, subsequently creating jobs, and improve its supply to key markets, the need for backward integration cannot be overemphasized.

READ ALSO: Agriculture: ‘1.2m oil palm hectares needed for Nigeria to become global leader’

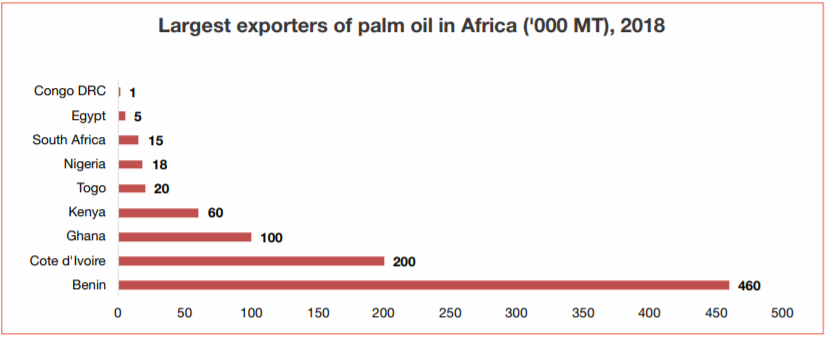

Despite being one of the world’s largest producers and exporters of palm oil, cocoa and groundnuts a few decades ago, reports have it that Nigeria today imports nearly 600,000 metric tonnes of palm oil.

Currently, Nigeria is the 5th largest producer of the product, with less than 2 per cent of the total global market production of 74.08 Million Metric Tonnes.

Côted’Ivoire, Ghana and Sierra Leone being major producers of both palm oil and palm kernel oil (PKO) in West African.

Indonesia and Malaysia, two countries that were far behind Nigeria in palm oil, today export over 90 per cent global of demand, while Indonesia earned $12.6 billion from its oil and gas sector in 2017, against $18.4 billion realised from palm oil exports.

According to the World Bank December 2019 price index for crude palm oil, Nigeria loses over N90 billion yearly to the importation of palm oil which it could produce.

According to the Central Bank of Nigeria, CBN, if the country had maintained it production market share of Palm Oil which was witnessed in the early 60s, today, the country would have been earning approximately $20 billion annually from cultivation and processing.

Nigeria was the world’s largest palm oil producer before and some years after its independence, with a global market share of 43 per cent.

However, in 1966, with much interest in the exploration and production of crude oil, Malaysia and Indonesia surpassed Nigeria to become the world’s largest palm oil producers.

Lagos was the leading port in colonial West Africa and Nigeria was the largest exporter of palm oil and palm kernel, demand for both had soared because of World War I. Nigeria made £9.5 million from exports in 1918, the highest since it was amalgamated four years earlier – 61 per cent was from palm oil and palm kernels.

Export revenues from palm oil and palm kernels were the main source of income for the colonial government. Then as now, Nigeria relied on a single commodity. Before World War I, palm oil was exported to Liverpool to make soap, and palm kernels were shipped to Germany to make cattle feed and the oil extracted from it was sold to the Dutch who made margarine from it.

Processing of Palm Oil

Palm plantation is in phases. It ranges from the nursery unit down to the plantation unit. Oil palm begins to produce between three to four years after it has been planted.

First, the seeds are kept in a room where the temperature is high, this makes the seeds germinate sooner, after 90 to 100 days.

READ ALSO: Poultry farmers bleed as Banks deny agribusiness funding

Each seed germinated is planted in a small plastic container, where a new leaf grows every month. The young seedling stays in the container for about four to five months. When you see a leaf with two points bifid leaf coming up, transplant the seedling out into the nursery.

The seedling stays in the nursery for one year. When it has about 15 green leaves, it is planted in the palm grove. The seedling is therefore 16 to 18 months old when it is ready to be planted in the palm grove.

The people in the plantation unit will buy from the nursery unit, they will do about three years more with them before you start putting, the first fruit wouldn’t be cut before you start harvesting it.

Formation of Palm Oil

Palm Oil production has a variety of usage. For example, it is used for industrial products and food consumption. Food consumption from palm oil to vegetable oil, power oil is also from palm oil after it has been bleached through, deodourised decolourisation and neutralisation amongst others.

Palm oil serves various purposes, either for industrial oil, cosmetics, pharmaceuticals or for agro-allied products which is been used as animal feeds.

The processing of palm oil after the seeds have been taking off from the plantation starts with the washing phase, which is usually done with treated water mostly under room temperature.

Next, you allow the seeds scalded in boiling water and removed after a brief timed interval, and finally placed under cold running water to halt the cooking process.

After which is the blanching phase. The palm liquid is allowed to get cold and settle the main palm oil comes up then you can now filter it and that’s all you need to do for your oil to be ready.

The oil may be separated into liquid and solid phases by controlled cooling, crystallization, and filtering, and the liquid fraction is used extensively as a cooking oil.

Market survey

When iBrandTV visited some of the markets in Lagos, Ogun to know the effect of Coronavirus on Palm Oil sector, the development was encouraging as the prices increased slightly in some parts, while other parts it remains same.

A palm oil seller at Agboju Market in Lagos, simply identified as Oluwashade, told our correspondent that Palm Oil remained as it were before the unwelcomed visitation of Coronavirus in February.

According to her, I buy 25 gallons of palm oil at N10,500 and still buys it same price now.

Her words: “I have been buying one 25 litres of palm oil for N10,500 and I sell 1.5 litres for N800 to my customers.

“Coronavirus is not affecting palm oil but other food items.”

Also, another wholesale marketer at Boundary market Mr. Ifeanyi Nwoke, told our correspondent that since the outbreak of the COVID-19 pandemic, he increased the price of 25 litres of palm oil to N10,000.

Nwoke said: “The rise in transportation fare forced me to add N700 to the cost of 25 litres gallon. Although there is no scarcity of the product, but I need to balance my sales with the current realities.”

Opportunity to bridge the demand gap

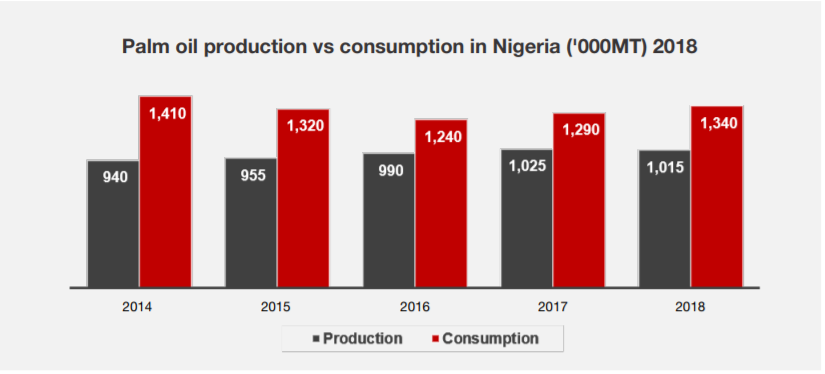

Meanwhile, Nigeria with a population estimated at 180 million, the highest in Africa, and also the largest consumer of palm oil in the continent has in recent time struggle to meet up with demands of the product for its citizenry.

A palm oil producer and refiner in Nigeria, Ajibola Adebutu, Managing Director of JB Farms, in a chat, said, “I process 200 tonnes of palm oil into vegetable oil daily, which means about 6000 tonnes a month.

However, Okumu Oil Palm Plc supplied me with 300 tonnes of palm oil for the month. “I use 6,000 tonnes a month, but it could only supply me 300 tonnes (one-and-a-half-day raw materials), so there is a huge gap.

To meet the supply gap of palm oil, the country had to depend on importation over the years. However, in 2015, the CBN published a list of 41 items, including palm oil, as ineligible for forex through the Nigerian interbank market to encourage local production and manage foreign reserves.

Also, a duty charge of 35 per cent was applied to crude palm oil (CPO). While this seems good in government’s effort at promoting local production of CPO, it has an impact on local manufacturers of refined vegetable oil and this include increase in the cost of local production of refined vegetable oil;

The Non-availability of enough palm oil for further refining by local manufacturers thereby resulting to idle capacity utilization and the Non-competitiveness in prices of locally produced refined vegetable oil due to the activities of smugglers of refined vegetable oil into the country.

Nigeria’s response to COVID-19 pandemic

The outbreak of Coronavirus (COVID-19) pandemic present another opportunity for Nigeria as a country to regain her stronghold in the production of palm oil.

Also, with the US and China trade war and the increase in import duties by India, the largest importer of palm oil in the world, Nigeria can take advantage of this development and engage in the massive development of the sector in the country.

READ ALSO: Insecurity is seriously affecting farmers – Atiku tells FG

To meet this gap, there is a need for President Muhammadu Buhari administration to look inward to improve the cultivation of palm plantation in the country and not merely by banning the importation of the product.

The government need to concentrate more on incentivising farmers and also creating a soft landing for them to ease the burden of capital, without which, we will only be boasting of 34 million hectares of arable land in papers.

For instance, each tree can produce 10 tonnes of fresh fruit bunches per hectare. On average 3.9 tonnes of crude palm oil and 0.5 tonnes of palm kernel oil can be extracted per hectare.

According to the CBN governor, Godwin Emefiele, “The COVID-19 pandemic and the immediate response of many of our trading partners suggest it is now more critical than ever that we take back control, not just control over our economy, but also of our destiny and our future.”

CBN intervention

Meanwhile, CBN had commended the effort of President Muhammadu Buhari administration in the promotion of backward integration.

According to Emefiele, “The CBN on its part created several lending programmes to provide hundreds of billions to smallholder farmers and industrial processors in several key agricultural produce.

“These policies and programmes, he said, were to reposition Nigeria to become a self-sufficient food producer, creating jobs, supplying key markets across the country and dampening the effects of exchange rate movements on local prices.

“CBN has consistently harped on the need to take decisive actions to fundamentally transform the structure of our economy against the damaging effects of unsustainable propensity to import.”