Every year, landlords in Lagos and other big cities in Nigeria continue to increase cost of rent, making it go out of reach for anyone who depends on the minimum wage. Workers are forced to move further down, away from the civilised part of the cities.

Not many of the residents could fathom why there is consistent increase that does not match their earnings. They look to the government for help, yet the government appears to have its hands tied.

Indeed, one thing residents who complain about rent increase do not see is this hidden cost we document in this article.

As dusk fell over Lagos, the hum of paint factories masked growing concerns.

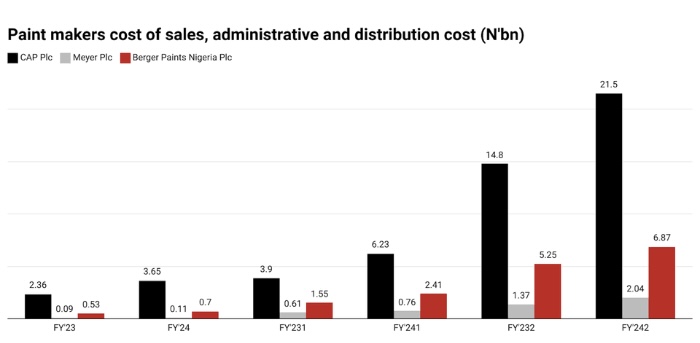

In 2024, Nigeria’s paint industry faced a 45% rise in production costs, with Berger Paints, Chemical and Allied Products (CAP) Plc, and Meyer Plc spending ₦44.2 billion — 88% of their total revenue of ₦50.21 billion.

This left shareholders with lower returns as inflation and naira devaluation drove up expenses.

Inflation And Currency Woes

Since inflation reached a 28-year high of 34.8%, manufacturers struggled with rising costs for essential raw materials like titanium dioxide, resins, and pigments — mostly imported.

A Lagos-based analyst highlighted how exchange rate volatility complicated cost management.

Meanwhile, on the other hand is rise in energy costs. This further squeezes profits.

It is a common thing for manufacturers to pass these costs onto consumers, but many Nigerians already faced financial hardship.

Profit Margins Squeezed

CAP Plc’s cost of sales jumped by 45%, while Berger Paints and Meyer Plc spent ₦6.87 billion and ₦2.04 billion, respectively.

Read Also; 2025 Budget: Nigeria’s Budget Per Person Falls Well Below $2.15 Poverty Line

Nevertheless, increased sales enabled CAP Plc to achieve a profit margin of 10.9%, Meyer secured 10.4%, and Berger recorded 5.75%.

Real Estate Sparks Hope

Despite these challenges, Nigeria’s booming construction and real estate sectors offered hope. According to the NESG-Stanbic IBTC Business Confidence Monitor for January 2025, the BCM Index improved slightly to -1.40 points from -3.46 in December 2024.

Ripple Effect On Housing And Rent Prices

In the end, Nigeria’s paint manufacturers continue to face a difficult economic landscape, with rising costs affecting both their businesses and the wider economy.

This higher prices for raw materials, energy, and paint are contributing to the rising cost of housing and rent, making it harder for Nigerians to make ends meet.

Yet, despite these challenges, the paint sector remains resilient, hoping that growth in infrastructure and real estate development will provide a lifeline in the years ahead.

Additionally, real estate activity grew by 18.67% points, creating new opportunities for paint manufacturers.

While economic pressures persist, companies that adapt to inflation, currency fluctuations, and operational challenges could still thrive.