Nigeria’s economy has shown resilience in the face of economic headwinds, with ten major sectors generating 857.3 billion naira in Company Income Tax (CIT) for the Federal Government in Q3 2024.

The sectors are manufacturing, mining, and quarrying, information and communication, financial and insurance activities, public administration and defence, and compulsory social security.

This represents a significant increase from 601.3 billion naira in the same quarter last year.

In the third quarter of 2024, ten major sectors in Nigeria raked in ₦857.3 billion as Company Income Tax (CIT) to the Federal Government, raising more revenue compared to ₦601.3 billion in the same quarter last year.

Data from the Federal Inland Revenue Service (FIRS) and the National Bureau of Statistics (NBS) revealed that Company Income Tax (CIT) for Q3 2024 declined by 28.2 percent to ₦1.77 trillion from ₦2.47 trillion in Q2 2024.

“Local payments received were ₦920.91 billion, while foreign CIT payments contributed ₦852.29 billion in Q3 2024,” it said.

CIT, also known as corporate tax, is a tax levied on the profits of companies operating in Nigeria. It is regulated by the Companies Income Tax Act (CITA) under the supervision of the Federal Inland Revenue Service (FIRS).

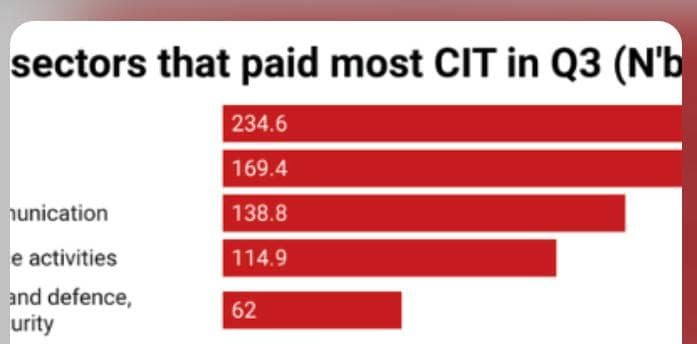

Despite economic headwinds, the manufacturing sector recorded the highest contribution with 25.47 percent, followed by mining and quarrying with 18.37 percent; and information and communication with 15.07 percent.

While there are moderate increases in companies’ income taxes, they do not equate to a rise in business profitability but reveal the revenue generated by the federal government per sector.

Here are the top 10 sectors that paid most taxes in Q3 2024

Manufacturing

The manufacturing sector contributed ₦234.6 billion to the federal government revenue in the three months to September compared to ₦155.7 billion in the same quarter last year.

The sector has continued to demonstrate resilience despite struggling with rising electricity tariffs that has led to higher energy costs, exchange rate volatility, and a 28-year inflation.

These headwinds have resulted in weakening purchasing power and backlog of unsold inventory which is eating into their profits. Their woes are compounded with an 875 basis points rise in interest rate in a year, limiting expansion and raising borrowing costs.

Despite these factors, manufacturers incurred more taxes that significantly hindered their business growth and profitability in Q3 2024.

Mining and quarrying

In Q3, company income tax from the mining and quarrying sector was the second highest, rising to ₦169.4 billion from ₦77.3 billion in Q3 2023.

Despite weak institutional reforms and policies stalling the country’s mining industry growth, the mining and quarrying sector incurred more taxes in Q3 2024.

Information and Communication sector

The contribution of this sector’s revenue to the federal government revenue declined by 22.9 percent to ₦138.8 billion in Q3 2024 from ₦170.6 billion in Q3 2023 due to an increase in regulatory burdens, changes in tax policies, rising inflation, and exchange rates fluctuation.

This sector covers technology and IT services companies like Paystack and Flutterwave; Telecommunication companies like MTN and Airtel, and Internet Service providers like Spectrum and Smile.

Financial and insurance activities

This sector saw a 62.7 percent increase in its CIT contribution to ₦114.9 billion in Q3 2024 from ₦70.6 billion in the same quarter last year.

The rise in the contribution of this sector to the government’s purse could be attributed to the naira devaluation and the elevated interest rate environment which means companies’ borrowing costs will continue to rise as authorities remain hawkish.

Companies in this sector are Tier-1 and Tier-2 banks, Mortgage banks, Microfinance banks and insurance companies.

Public administration and defence, and compulsory social security

The Public administration and defence, and compulsory social security increased its CIT contributions to ₦62 billion in nine months of 2024 from ₦44.9 billion in Q3 2024.

Electricity, gas, steam and air conditioning supply

This sector’s company income tax contribution surged by 252 percent to ₦33.1 billion in Q3 2024 from ₦9.4 billion in the same period last year.

Wholesale and retail trade, repair of motor vehicles and motorcycles

The Wholesale and retail trade, repair of motor vehicles and motorcycles sector’s contribution to the federal government rose to ₦16.1 billion in the first quarter of the year.

Transportation and storage

In nine months of 2024, the company income tax of the transportation and storage sector rose to ₦29.9 billion from ₦15.2 billion in Q3 2024.

Professional, scientific, and technical activities

The professional, scientific, and technical activities contributed ₦14.9 billion in Q3 2024, a 75.9 percent increase from ₦8.5 billion reported in the same quarter of 2023.

Other services

Other services such as healthcare, legal, real estate, education, media, and entertainment contributed ₦26.8 billion in nine months of 2024 compared to ₦22.1 billion in Q3 2023.