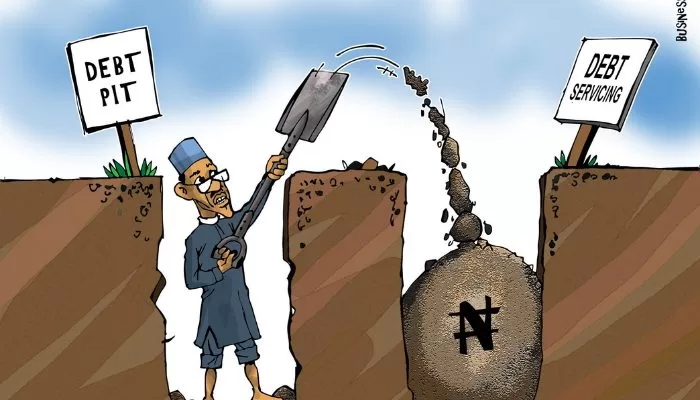

Rather than make effort to avert debt, Nigeria is getting more and more comfortable with the idea of being indebted, either to international financial institutions or other countries.

So, while many other countries of the world are creatively looking inward and generating revenues for developing infrastructures, Nigeria is interested in taking long terms loans.

Today, government agencies like the Debt Management Office (DMO) among others are confident to encourage the Federal Government to get loans from World Bank and International Monetary Fund (IMF).

Read Also: Breaking: FG Declares May 1 Public Holiday To Mark Workers’ Day

While these loans truly may come at a reduced interest rate and have long repayment plan, it is better for Nigeria to stop going “cap in hands” looking for whom to borrow from.

The above view was that of Tilewa Adebajo, the Chief Executive Officer of CFG Advisor.

Mr. Adebajo made frantic efforts on national television to explain the troubles of going for loans.

Mr. Adebajo emphasised that the Nigerian government needs to stop borrowing and focus more on debt restructuring in order to revamp the economy.

He said the official total debt profile of Nigeria was alarming.

Comparing America’s Debt-to-GDP Ratio, which is over 101%, to Nigeria’s Debt-to-GDP Ratio, which is 40%, Adebajo said American government spends a single digit of 8% to service her debts, while Nigerian government spends double digits of 96% to service her debts.

Need For Internal Debt Restructuring

He believes no nation will continue to finance a deficit economy except such nation wants to go bankrupt.

“Nigeria therefore cannot continue to service debt, but should rather restructure her debt financing in order to grow the economy, before economies of the world force us to restructure our debt financing.

“Nigeria therefore needs internal debt restructuring as a matter of urgency,” Adebajo said.

He advised the in-coming government on how best to restructure Nigeria’s internal debt profile.

Also, the CEO of the CFG Advisor wants the government to first reduce the current double unit interest rates to a single digit interest rate.

According to him, this will grow the economy much faster.

He said the current bank’s lending rate of 30% remained high and a disincentive to business growth.

“Nigeria must tame inflation in order to drop interest rate to a single digit. Nigeria must unlock the different financial restrictions and create an enabling environment for businesses to thrive,” Adebajo further said.

Focus On Social Infrastructure

Addressing the issue of economic stagnation, Adebajo said Nigeria should begin to focus on social infrastructure, healthcare and education.

You Can Also Read: Lagos Spare Part Dealer Arraigned For Sexual Assault

According to him, Nigeria has no functional refineries across the county, even though Nigeria is one of the largest producers of oil in the world.

“If only Nigeria can put its social and economic infrastructure in place, Nigeria can become a $1 trillion economy and compete with other economies.

“It is not rocket science to achieve it because the country has technology savvy organisations and individuals that can help the country achieve it.

“There are several institutions that the government needs to refocus and make them economically viable.

“Currently, our Foreign Direct Investment (FDI) is less than ₦1 trillion.

“What is saving Nigerian government is the inflow of start-up capital from around the world.

“Most global Venture Capitalists (VCs), still believe in Nigeria and African startups and have continued to invest in startups in Nigeria and other African countries, and that is the reason Nigeria still remains the largest economy in Africa,” Adebajo said.

He advised that institutions like the Nigeria National Petroleum Corporation (NNPC) and the Nigerian Liquefied Natural Gas (NLNG), should be restructured to boost oil production in Nigeria.

This, he says, will raise sustainable money from oil and gas production for the country.