The CBN’s aggressive rate hikes have turned into a financial windfall for four mid-sized banks—Wema Bank, FCMB, Stanbic IBTC, and Sterling Holdco.

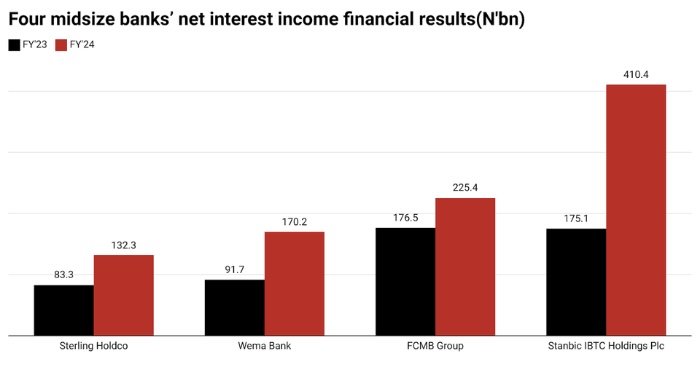

Their combined net interest income jumped 78% to ₦938.3 billion in 2024, up from ₦526.6 billion in 2023, as higher rates boosted earnings.

An analysis by reporters reveals that these banks collectively increased their net interest income to ₦938.3 billion, up from ₦526.6 billion in 2023.

Stanbic IBTC led the way by raising its earnings to ₦410.4 billion, compared to ₦175.1 billion in the previous year.

Meanwhile, FCMB Group expanded its income to ₦225.4 billion, Wema Bank boosted its revenue to ₦170.2 billion, and Sterling Holdco grew its figures to ₦132.3 billion.

According to a Lagos-based analyst, interest rate hikes primarily drive banks’ net interest income, which reflects the difference between interest earned on loans and paid on deposits.

Read Also; FG In Talks With Stakeholders To Lower Freight For Non-Oil Exports

Since taking office, the CBN Governor, Olayemi Cardoso, has raised the Monetary Policy Rate (MPR) six times to curb inflation and attract capital inflows.

However, at its 299th meeting in February 2025, the MPC decided to hold the MPR at 27.5% after the National Bureau of Statistics (NBS) rebased the Consumer Price Index (CPI).

This adjustment led to a drop in Nigeria’s headline inflation to 24.5% y/y in January 2025, down from 34.8% in December 2024.

Furthermore, bank performance varied significantly. Stanbic IBTC achieved the highest growth at 134.2%, while Wema increased by 85.6%, Sterling Holdco expanded by 58.8%, and FCMB Group improved by 27.7%.

Although the CBN’s policies continue to enhance banks’ earnings, analysts caution that these measures may slow down broader economic growth due to rising borrowing costs.