Amid the high economic inconsistency that is currently prevalent in the country, the Nigerian Treasury Bills market experienced a phenomenal surge of 98.58% in July.

While many businesses in Nigeria are experiencing down times, investors are shying away from investing due to the uncertainties prevalent in the economy.

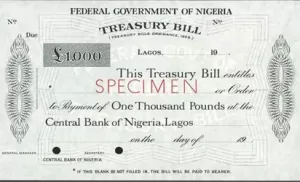

The Central Bank of Nigeria (CBN) has reported an increase of ₦406.1 billion from the Nigerian Treasury Bills (NTB), in July 2023.

According to the CBN “Government Securities Summary,” report, the NTB auction was oversubscribed by 37.26% or ₦1.09 trillion, indicating significant investor interest.

This depicts a remarkable 98.58% increase from the ₦277.27 billion raised in June 2023.

To attract investors, the CBN offered attractive yields on its NTB, capitalising on a bullish sentiment despite rising inflation rates and a hike in the Monetary Policy Rate (MPR).

The new government foreign exchange policy of the government contributed to a renewed interest in the stock market.

The primary purpose of raising fresh capital through the NTB was twofold: to mop up excess liquidity in the system and to provide short-term bridging funds to support the federal government’s budget spending.

Second Auction

According to the CBN, only two NTB auctions were carried out in July with the average yield on 356-day NTB increasing to 12.15% during the second auction from the previous 5.94% in the first auction.

Also, NTB auction result, the 91-day interest rate, increased to 6% from 2.86%, while the 180-day auction interest rate was at 8% from 3.5%.

The CBN said it raised ₦141.77 billion in its first auction in July and recorded ₦691.86 billion oversubscription.

In the second auction, the CBN raised ₦264.33billion and ₦398.17 billion oversubscription.

The double-digit increase in 364-day NTB, according to analysts, is coming on the backdrop of hike in MPR to 18.75% in July.

The Monetary Policy Committee (MPC) of the CBN had voted to increase the MPR further by 25 basis points to 18.75% at its July policy meeting.

Healthy Liquidity Profile

Cordros Research in a report expressed that it expected the financial system liquidity profile to remain healthy in the near term, partly driven by increased FAAC inflows.

“With our expectation that the MPC is at the end of its monetary policy tightening cycle, risk appetite for mid to long-dated bonds is likely to improve.

“Nonetheless, we maintain our expectations that yields in the fixed-income market are still bound to rise further from current levels.

Also Read: See How CBN Plans To Ensure Financial Stability

“Our prognosis is hinged on our expectation of a sustained imbalance in the supply and demand dynamics, more so that the FGN’s 2023FY borrowing needs remain high.

However, we highlight that deliberate actions by the DMO to keep the borrowing costs at a moderate level and a possible maturity of CBN special bills present as downside factors,” it stated.

You could be shocked to see that people are buying Nigeria Treasury Bills amidst the hardship many profess.

Here’s What Tinubu Said About The Current Nigeria’s Hardship