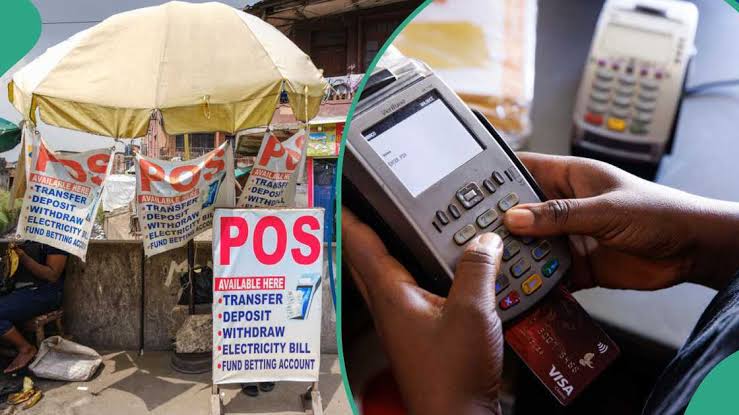

In Lagos, POS agent Adesokan considers how the CBN’s new ₦100,000 daily withdrawal limit would impact her business, as Nigeria pushes towards a cashless economy.

On Tuesday, the Central Bank of Nigeria (CBN) introduced a new policy limiting daily cash withdrawals to ₦100,000 per customer for Point of Sale (POS) transactions.

Oladimeji Yisa Taiwo, who signed the directive on behalf of the Director of the Payments System Management Department, explained that this move would streamline agency banking operations and promote a cashless economy.

In the directive addressed to Deposit Money Banks, Microfinance Banks, Mobile Money Operators, and Superagents, the CBN outlined strict rules.

First, agents must ensure no customer exceeds the ₦100,000 daily limit, while agents themselves cannot perform more than ₦1.2 million in total daily cash-outs.

Moreover, the policy limits customers to ₦500,000 in weekly withdrawals.

To ensure compliance, the CBN requires agents to separate banking services from other business activities.

Read Also; NERC Unveils Tool For Cost-Reflective Mini-Grid Tariffs

Furthermore, all transactions must use the approved Agent Code 6010 and occur through float accounts maintained with principal institutions.

Most importantly, financial institutions must monitor accounts linked to agents’ Bank Verification Numbers (BVNs) to prevent unauthorised activities.

Additionally, the CBN mandates that POS agents connect their terminals to the Payments Terminal Service Aggregator (PTSA).

Agents must also send daily transaction reports to the Nigerian Inter-Bank Settlement System (NIBSS) using a template the CBN will provide.

Significantly, the CBN warned that principal institutions remain accountable for their agents’ actions.

It also announced plans for regular oversight, including backend system checks.

Finally, the apex bank emphasised that any violations would attract harsh penalties, such as fines and administrative sanctions.

This policy reflects the CBN’s commitment to creating a secure, efficient, and transparent agent banking system while advancing Nigeria’s cashless economy.