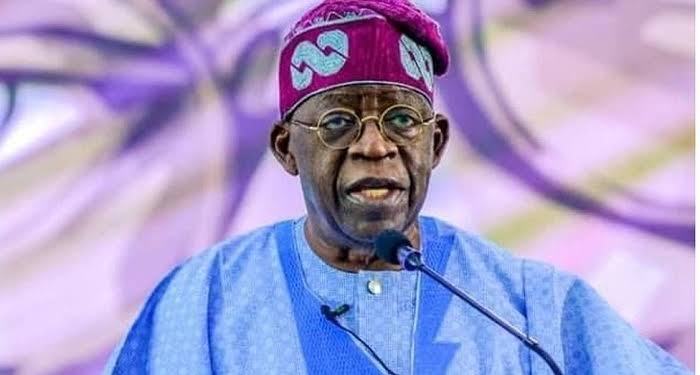

From May 29 Bola Tinubu will take over office as the President of Nigeria, taking over huge amount of debt from the current administration.

Experts say this debt is capable of making things tougher for Nigerians in coming months and days.

It is worrisome to some international organisation and the International Monetary Fund (IMF) is one of them.

Now it wants the Tinubu to think out of the box and look for ways to increase the country’s revenue base.

IMF Resident Representative in Nigeria, Ari Aisen, made this remark during a virtual forum on the Nigerian debt situation.

Spending More Than Revenue

Aisen, also advised the incoming government to drastically reduce dependence on debt to fund expenditures.

Read Also: IMF Concerned About Nigeria’s CBDC 1.4m Transactions

Nigeria’s public debt stock, which includes domestic and external debt stocks of the Federal Government, 36 state governments and the Federal Capital Territory was ₦46.25 trillion (USD103.11 billion) at the end of December 2022.

This advice is coming at a time when Nigeria still owes the IMF about $13.04 billion.

According to Aisen, “to resolve the debt issues of Nigeria you need to concentrate on revenue and expenditure”.

He said that, the debt situation had deteriorated because the Federal Government was spending more than it was actually getting in revenues.