There are indications that non-Interest finance products have played a critical role in the growth and development of the Nigerian capital market ecosystem.

Although, the rate of development at the Nigerian capital market has not been able to effectively mobilize capital for the development of other vital sectors of the Nigerian economy.

For instance, difficulties ranging from poor infrastructural facilities, low level of public awareness as to the benefits derivable from the operation of the capital market, the inadequacy of supply of securities, stringent stock exchange listing requirements amongst others have continued to make the sector non-viable.

However, a stakeholder in the industry has hinted that the non-interest finance instruments, assets, and products had been identified as catalysts for leading and developing economies globally.

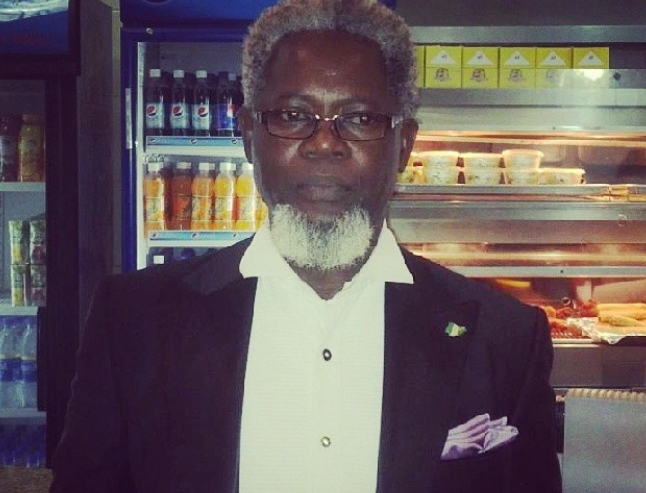

Mr. Akeem Oyewale, the CEO of Marble Capital, while speaking on “Islamic Finance And the Investment Opportunities in the Capital Market” stated that, the Islamic finance segment of the financial market presents numerous opportunities for enhancing the economic fortunes of Nigeria, and over 80 countries have adopted this.

Looking at the Islamic Finance and Investment Opportunities in the Capital Market, Mr. Akeem Oyewale highlighted significant investment opportunities in the non-interest capital market. According to him, the Islamic capital market products available include;

Sukuk bonds-Sukuk are certificates issued to investors representing a tangible asset, service, project business or joint venture. The asset must be Shariah-compliant. Sukuk has been issued so far by Osun State and three times by the Federal Government.

Sukuk is the most used instrument in Islamic finance, making investors own a piece of certificate in an asset. Islamic finance operators encourage investments in fixed assets. Oyewale noted that if non-interest investments were in the capital market, the last financial crisis would have been averted.

READ ALSO: SEC rolls out new finance principles for CMOs to boost market resilience

He added that the Islamic capital market allows individuals/investors to invest based on tangible assets, and Sukuk is a common way of representing that. The instrument has benefitted more than the conventional bond because it is asset-backed and asset-based.

Equities- Another Islamic capital investment is equity, such as the lotus Halal fund or Lotus Islamic index listed on the Nigerian Stock Exchange. This allows investors in the capital market to invest in Halal-compliant stocks. From the analysis, this has performed better in terms of dividend yield, actual capital appreciation than the relatively non-Halal stocks.

Commodities– Commodities involve investing in securitized products that are asset-backed and not prohibited under the Shariáh law. Akeem explained that the commodities are Halal compliant. Investors need to be aware that the opportunities to invest in shariah-compliant commodities exist to take advantage of the securities like agricultural products.

Mutual Funds- The Islamic mutual funds are open-ended investments that pull investor’s finances together to invest in various Shariah-compliant securities, like Islamic equities commodities and Sukuks or a mix of multiple securities.

It allows individuals to invest a small amount of money and diversify their asset classes from N10,000 investment. These include Stanbic IBTC Shariah-compliant fund, United Capital Sukuk fund, Lotus fund, amongst others.

Islamic Unit Trust– This is similar to a mutual fund, and it is the type of investment used to plan for Hajj pilgrimage, marriage, or mortgage.

Islamic Exchange Traded Fund (ETFs) are also open-ended baskets of securities that track an index (es) / sector or commodities or other assets, but which can be purchased or sold on a stock exchange like a regulator stock. The Islamic ETF product is not yet in Nigeria.

Islamic Derivatives– Derivatives are contracts that derive their value from the underlying asset and agreement and are helpful for risk management. This fundamental agreement is called hedging and is a forward contract. It is preferred for commodities investments.

The growth of Islamic Finance in Nigeria

- In 2011, the guidelines for the regulation and supervision of the non-interest institutions offering non-financial services in Nigeria.

- In 2013, Osun State Sukuk bond was issued and oversubscribed

- In 2016, Jaiz bank upgraded to a National Bank

- In 2017 September, the FGN 100bn Sukuk bond was issued

- In 2017, the CBN issued the guidelines for the regulation and supervision of non-interest Islamic Microfinance banks

- In 2018 December, the FGN issued N100bn Sukuk bond

- In 2019, TajBank commenced its operation as the 2nd non-interest bank

- In 2020, the FGN 150bn Sukuk bond Issuance witnessed 446% oversubscription, and Osun State Sukuk was fully repaid to investors.

- In 2021, the Central Bank of Nigeria granted Lotus Bank a license to commence non-Interest Banking

Benefits of Islamic Capital Markets

| Individuals | Organizations | Governments |

| Offers Muslims and other ethically conscious investors the opportunity to invest without comprising their convictions | A good source of funds for asset growth | Reducing economic disparity |

| Promotes social justice | Ease of payment of funds acquired | Enhancing ethics, equity, and property rights |

| Offers highly competitive returns | Expanding the market participants

|

Perfect for financing large infrastructure projects |

In Islamic finance, all investments must adhere to Islamic rules of investments and also comply with the regulations governing the conventional counterparts.

He believed that the Islamic Finance industry was well poised for growth and should be well utilized by all entities, individuals, organizations and government.

Proshare