Nigeria’s stock market gained this week, surpassing ₦60 trillion in market capitalisation and closing the All Share Index (ASI) at 99,189.95 points.

Year-to-date returns are 32.65 per cent, with a 1.14 per cent rise this week, as investors traded 400.9 million shares worth ₦15.715 billion.

Nigeria’s stock market has shown a strong upward trend this week, remaining positive in all four trading sessions.

Nigeria’s stock market has shown a strong upward trend this week, remaining positive in all four trading sessions.

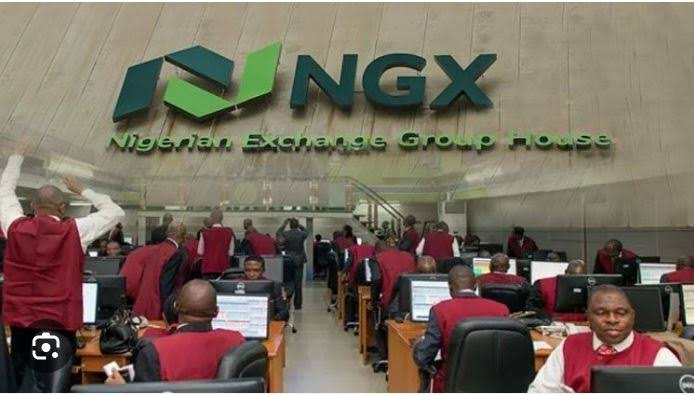

This surge is primarily driven by the ongoing third-quarter (Q3) earnings season, which has spurred increased investor interest at the Nigerian Exchange Limited (NGX).

Gainers And Losers

As market participants focus on fundamentally solid companies, the market capitalisation has impressively surpassed the ₦60 trillion mark.

Furthermore, stocks such as Access Holdings, UPDC, Cornerstone Insurance, and Academy Press have led this rally, contributing significantly to the market’s gains on Thursday.

Read Also; Haldane McCall Receives Green Light To Launch 3.12 Billion Shares On NGX

On that day, the market rose by 0.25 per cent, with the Nigerian Exchange Limited All Share Index (ASI) climbing to 99,189.95 points and market capitalisation reaching ₦60.103 trillion.

In addition, year-to-date (YtD), the market boasts a commendable return of 32.65 per cent, reflecting a 1.14 per cent increase this week and a 0.64 per cent rise this month.

Specifically, Access Holdings topped the gains, soaring from ₦20.10 to ₦22.10, an increase of 9.95 per cent. Similarly, Academy Press rose from ₦2.86 to ₦3.14, gaining 9.79 per cent.

Moreover, UPDC also increased from ₦1.46 to ₦1.59, while Cornerstone Insurance went from ₦2.50 to ₦2.69.

Throughout this week, investors participated in 9,211 transactions, exchanging 400,912,759 shares worth ₦15.715 billion.

Notably, there was significant activity in UBA, Japaul Gold, Custodian Investment, Access Holdings, and Zenith Bank, reflecting a vibrant market atmosphere.