Amina, like 29% of Nigeria’s displaced persons, struggles without access to financial services due to a lack of ID and proof of address, a Central Bank report reveals.

Financial Exclusion Of Displaced Nigerians: Barriers And Solutions

In a camp on the outskirts of Borno State, Amina weaves a basket. Her livelihood has been hampered by a lack of financial access.

Like many internally displaced persons (IDPs) in Nigeria, she cannot access formal financial services without an ID or proof of address.

This is coming to limelight after the Central Bank of Nigeria (CBN) reports that 29 per cent of IDPs experience financial exclusion due to barriers such as insufficient documentation and limited infrastructure in underserved regions.

Read Also; Dangote Refinery Shifts From Nigeria, Exports To West Africa

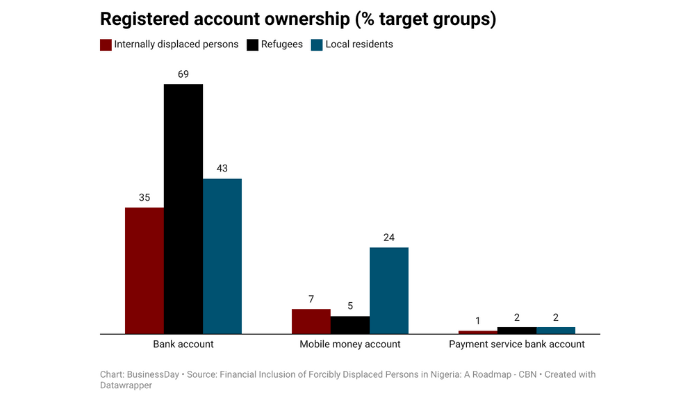

In its report, ‘Financial Inclusion of Forcibly Displaced Persons in Nigeria: A Roadmap’, the CBN highlights the struggles of IDPs, refugees, and residents across seven states, including Borno, Yobe, and Zamfara.

Furthermore, the survey, which included 1,677 respondents, shows that 24 per cent of residents and 21 per cent of refugees lack access to digital financial services.

Also, gender disparities stand out sharply in the data.

For example, male refugees achieved the highest inclusion rate at 77 per cent. On the contrary, only 39 per cent of female IDPs gained access, relying instead on informal networks.

In addition, high costs deter many from accessing financial services.

Expensive fees and lack of transparency push Nigerians, including IDPs, to avoid formal services.

In fact, a related study found that 30 per cent of adults consider bank charges unaffordable.

Nevertheless, initiatives like the Shared Agent Network Expansion Facility (SANEF) are improving rural access.

To address gender gaps, the CBN recommends deploying female financial agents in areas with high FDP populations and expanding digital solutions such as USSD codes and QR-based payments.

Ultimately, Amina, like millions of displaced Nigerians, dreams of rebuilding her future.

For people like her, the CBN’s roadmap offers hope. It outlines strategies to make financial inclusion a reality for Nigeria’s most vulnerable.