With a push to revitalise its underdeveloped non-associated gas reserves, Nigeria is introducing tax credits of up to $1.00 per thousand cubic feet through the 2024 Tax Bill.

The country holds $257 billion worth of untapped gas, yet these fields account for only a small fraction of its daily production.

The country holds 106.67 trillion cubic feet (Tcf) of NAG, which accounts for more than half of its total gas reserves.

These incentives aim to accelerate development, particularly in onshore and shallow water fields, where infrastructure challenges have slowed production.

Propose Tax Credits Bill Incentives

The bill, which the House of Representatives is currently reviewing, proposes tax credits of up to $1 per thousand cubic feet for fields with low hydrocarbon liquid content (less than 30 barrels per million standard cubic feet).

However, fields with higher liquid content will receive a reduced credit of $0.50 per thousand cubic feet.

Read Also; Nigeria Moves To Revive Trans-Saharan Gas Pipeline With New Agreement

The credits will apply to gas projects that achieve first commercial production by January 1, 2029, and will remain valid for 10 years.

Unlocking Investment Potential

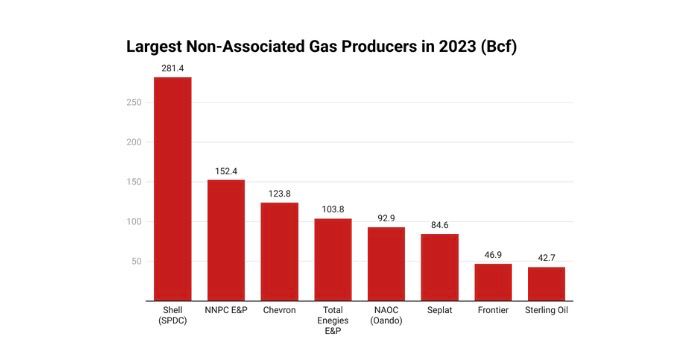

Nigeria, which ranks ninth in the world for gas reserves, produces 39% of its gas from non-associated fields, despite these fields making up the majority of total reserves.

To boost production, the government expects the tax credits to attract investment in underdeveloped areas.

Shell’s Role In NAG Production

Shell, Nigeria’s largest producer of NAG, will benefit significantly, but the Renaissance Consortium will inherit these assets after Shell’s divestment.

However, the Soku gas field, a key asset, may not qualify for the tax credits due to increased oil output, which could disqualify it from the incentives.

Once the bill passes, Nigeria expects the tax credits to unlock significant investment, thereby spurring the growth of its underutilised gas reserves and reshaping the country’s energy sector.