The Nigerian Investment Promotion Commission (NIPC), has disclosed that about 80 per cent of bilateral agreements signed in the past needs to be renegotiated.

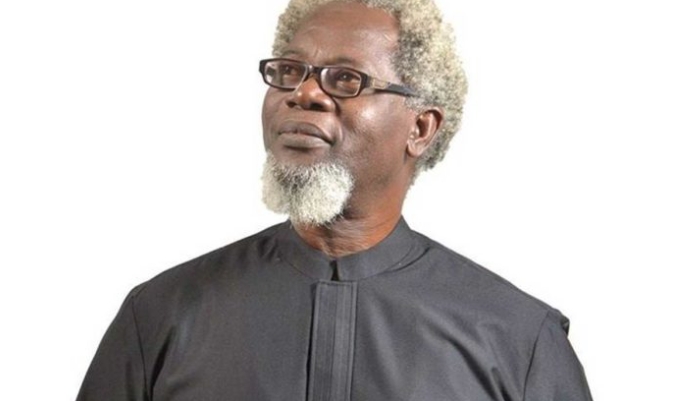

Yewande Sadiku, NIPC’s Executive Secretary, disclosed this during an interview on Arise TV.

Sadiku, who was appointed by President Muhammadu Buhari in 2016, will end her first tenure as chief executive officer of NIPC on September 26.

Speaking during the interview, the NIPC boss said previous treaties made by the Nigerian government needs to be modernised.

She said such efforts would help ensure that targetted investments are in line with the sustainable development goals.

“As with all government agencies, we worked with limited resources, so we thought it would be good to define where NIPC has to focus its energy. In the context of investment generally, we defined the ethos that should drive Nigeria’s investment search,” she said.

“We defined it as Responsible Inclusive Balance and Sustainable (RIBS). So the first thing we did in that regard is to look at the quality of the bilateral investment treaties that Nigeria has signed over the years.

READ ALSO: Foreign investors returning to Nigeria — Minister

“Apart from reforming the template that we then used to negotiate investment agreements going forward, that review gave us a startling picture.

“We saw that something like 80 percent of the bilateral investment treaties that we signed in the past needs to be renegotiated and modernised to ensure that they can achieve the kind of investment that we want. An investment that moves us towards Sustainable Development Goals.”

Sadiku disclosed that NIPC remitted N1.9 billion to the consolidated revenue fund in 2020.

She said, under her leadership, the commission generated N11.9 billion internally generated revenue since she emerged as head of NIPC.

“The CRF remittance we had in 2020 was N1.9 billion. Over the five years that I have been in NIPC, the total IGR that we have generated in that period, including the first half of 2021, which has been interesting, has been N11.9 billion,” she said.

“Of that, we have remitted N5.8 billion to the consolidated revenue fund. Roughly, about 49 percent of what we have generated in five years have been remitted to the consolidated revenue fund.”

Sadiku added that NIPC should not be regarded as a revenue-generating agency, saying the business of investment promotion “is typically a public good, it is not revenue generation”.

She said her administration invested in building the capacity of NIPC staff members to improve investment promotion campaigns.

The NIPC boss also said there is renewed transparency in the pioneer status incentive process as members of the public can now identify those who have benefitted from tax holidays.

“On the government side, we have given the cost of pioneer status incentive so it can guide the reform of the process and help us to measure whether it has helped to achieve its objectives,” she added.

Cable