As children’s day celebration approaches in Nigeria, the need to educate children, particularly the Nigerian child, on how to handle finance has been emphasised.

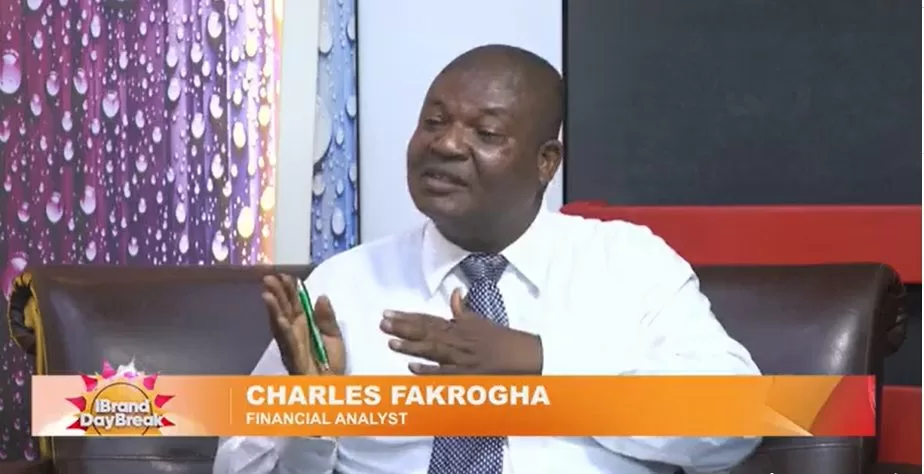

Addressing this topic on the Personal Finance segment of iBrand TV’s flagship programme; iBrand DayBreak, Charles Fakrogha, suggested that children should be taught how to make money early.

Charles Fakrogha is a financial analyst and a professional stock broker, with years of experience in the industry.

He is also a personal finance trainer.

Fakrogha, made this point while speaking on ‘Personal Finance For Kids’.

From his statements, children need to start been introduced to how to handle finance and how to make money.

He advocates that there should be a legislation from government for children to be taught financial literacy.

According to him, this is one aspect of education that is not mostly taught in schools. Sadly, parents often fail to pay attention to this.

Financial Literacy Lessons For Children

To empower children enough to be able to manage finances, the financial analyst listed a few lessons that children need before they start handling money:

- Self-control

- Humility

- Resilience

- Responsibility

- Value of adult guidance

- Moral value

Mr. Fakrogha believes that children need to start understanding the value of monetary exchange which revolves around buying and selling.

“A child needs to know the value of a Naira before it is handed to him.

“A child who has a very good childhood will have a good adulthood.”

He said the major reason children should be trained on financial literacy is because when they understand what it takes to make money, they will put in the efforts.

Related Articles

- Shocking! See 10 Problems Common To Microfinance Banks In Nigeria

- Reasons For High Rise Of Out-Of-School Children- Buhari Aide

“For instance, getting pocket money for cleaning the house or getting monetary rewards for doing some other house chores.

“This pocket money you must account for at the end of the week, how it was spent, why it was spent and so much more.”

As the Children’s day approaches, financial literacy is one of the gifts parents could give their children that will last a lifetime.

Earlier this year, the Nigerian Exchange in collaboration with the Central Bank of Nigeria and the Security and Exchange Commission had a week training for children on investment culture.

For the expert, our children must understand the difference between needs and wants, so that they can spend wisely.