As Nigeria’s interest rates soared, FBN Holdings rode the wave to a remarkable financial milestone.

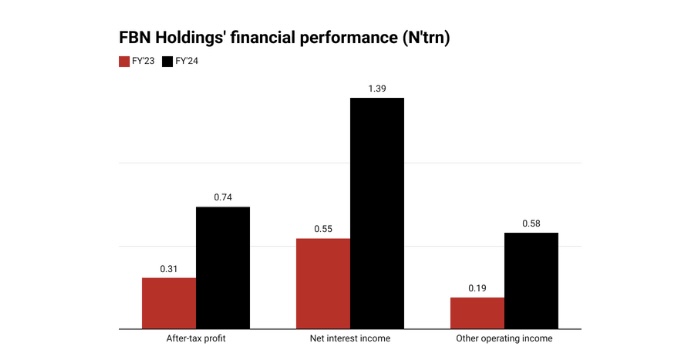

The banking giant’s latest financial statement reveals a staggering 154.5% surge in net interest income, fuelled by the Central Bank of Nigeria’s persistent rate hikes.

Rising Interest Expenses

Interest income nearly tripled to ₦2.42 trillion, while interest expenses surged 164% to ₦1.03 trillion.

Analysts highlighted a 123.7% increase in income from loans and greater exposure to Nigerian Treasury bills (NTBs), boosting investment income.

FBN Holdings Benefits From Interest Rate

Operating income climbed to ₦58.8 billion from ₦19.1 billion, while after-tax profit surged 138% to ₦738 billion.

Read Also: “4% FOB Levy: A Necessary Step Or A Burden On Consumers?” – Saraki

External revenue hit ₦3.3 trillion, with commercial banking contributing ₦3.2 trillion.

Fee income reached ₦302 billion, while expenses stood at ₦63.7 billion.

Mixed Income Performance

Foreign exchange income fell to ₦62.5 billion from ₦334 billion, but dividend income rose 71.9% to ₦9.8 billion.

Net cash flow from operations grew 36% to ₦1.57 trillion, and cash equivalents more than doubled to ₦5.2 trillion.

By leveraging rising interest rates, FBN Holdings has strengthened its financial position, showing resilience in Nigeria’s evolving economy.