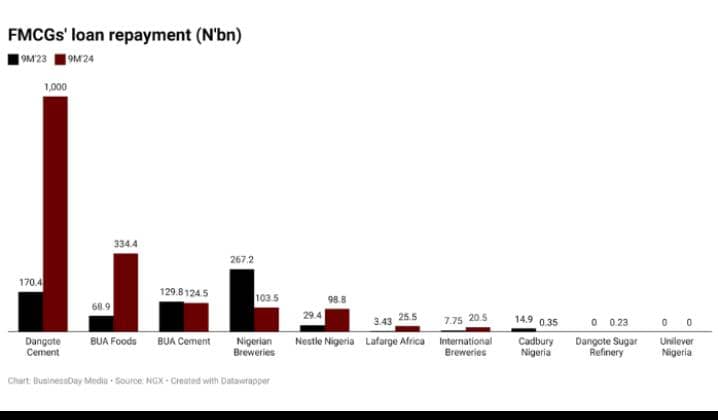

Nigeria’s Fast-Moving Consumer Goods (FMCG) firms have repaid a staggering ₦1.7 trillion in loans in the first nine months of 2024.

The significant loan repayment costs have put pressure on the firms’ cash flows, amid economic headwinds such as naira devaluation and rising interest rates.

Dangote Cement, BUA Foods, and Lafarge Africa were among the firms with the highest loan repayment costs, with Lafarge Africa recording a 643% increase in loan repayment.

The firms, including Dangote Cement, BUA Foods, and Nestle Nigeria, have been grappling with economic headwinds such as naira devaluation, which led to record foreign exchange losses.

The Central Bank of Nigeria’s (CBN) decision to increase the benchmark interest rate by 875 basis points to 25.7 per cent has also contributed to the surge in loan repayment costs.

Breakdown of the loan repayment costs for each of the nine FMCG firms:

Dangote Cement

₦1 trillion, up from ₦170.4 billion in the same period last year. Net cash from financing activities stood at a negative ₦686.7 billion.

BUA Foods

₦334.4 billion, up from ₦68.9 billion. Net cash from financing activities stood at a negative ₦455.07 billion.

Lafarge Africa

₦25.5 billion, down from ₦3.43 billion. Net cash from financing activities stood at a negative ₦70.1 billion.

Nestle Nigeria

₦98.8 billion, up from ₦29.4 billion. Net cash from financing activities stood at a negative ₦105.8 billion.

International Breweries

₦20.5 billion, down from ₦7.75 billion. Net cash from financing activities stood at ₦131.9 billion.

Dangote Sugar Refinery

₦0.23 billion, down from zero in the same period last year. Net cash from financing activities stood at ₦204.2 billion.

BUA Cement

₦124.5 billion, down from ₦129.8 billion. Net cash from financing activities stood at a negative ₦89.34 billion.

Nigerian Breweries

₦103.5 billion, down from ₦267.2 billion. Net cash from financing activities stood at ₦179.8 billion.

Cadbury Nigeria

₦0.35 billion, down from ₦14.9 billion. Net cash from financing activities stood at a negative ₦3.49 billion.

Also Read: Stockbrokers Urge Listing Of NNPCL, Other State Enterprises To Boost $1 Trillion Economy

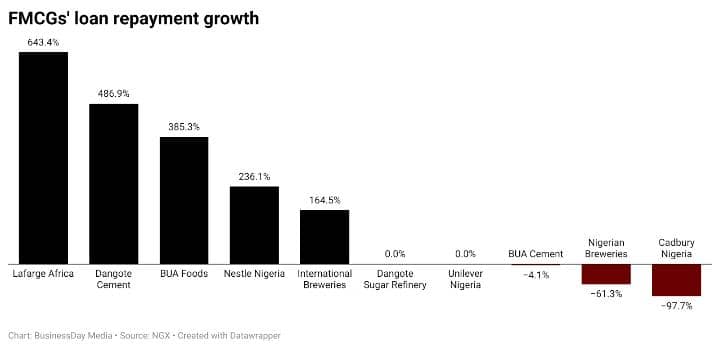

Firm Analysis

Lafarge Africa recorded the largest growth in loan repayment, with a 643 percent increase, followed by Dangote Cement (487 percent), BUA Foods (385 percent), Nestle Nigeria (236 percent), and International Breweries (165 percent).

In contrast, Unilever Nigeria did not repay any loans during the period.

The significant loan repayment costs have put pressure on the firms’ cash flows, with many reporting negative net cash from financing activities.

However, some firms, such as Dangote Cement and BUA Foods, have managed to generate positive net cash from operating activities, indicating their ability to navigate the challenging economic environment.