Nigeria’s foreign inflows have summersault due to low foreign participation in trading activities at the Nigerian Exchange Limited in 2023.

The decline is considered the lowest in almost 15 years.

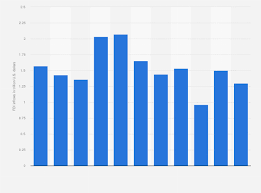

Foreign investors’ purchases of Nigerian stocks in the Stock market have declined for the sixth straight year.

This was revealed by new official data which showed foreign investors remained on the sidelines despite reforms that sparked a massive rally in the market.

According to data from the Nigerian Exchange Limited (NGX), foreign investment fell from ₦195.76 billion in 2022 to ₦174.80 billion last year.

The NGX revealed that this figure is the lowest since 2008.

Foreign inflows plunged in the thick of the global financial crisis that led to a stock market crash in the country to ₦153.46 billion in 2008.

Stocks worth ₦235.82 billion were offloaded by foreign investors last year, up from total sales amounting to ₦183.47 billion in 2022.

Have You Read: Stock Market Maintains Bullish Trend With ₦673bn Gain

With the higher foreign outflows seen in 2023, the market reversed 2022’s net inflows of ₦12.29 billion – which was the first since 2017.

With these, foreign investments in the market dipped to 11.48% from 16.32% in 2022, while local share of total transactions rose to 88.52% from 83.68%.

The market suffered a net foreign outflow of ₦61.02 billion in 2023, even as it rallied for the first time in an election year since 2007, racing to a 15-year high.

It finished the year with a return of 45.90%, more than double that of 2022 and the highest in three years.

What Analysts Are Saying

Analysts attributed last year’s robust performance to the reforms implemented by President Bola Tinubu, corporate earnings, and new listings on the NGX.

“The policy stance of the government rejuvenated confidence in Nigeria’s financial market.

“Fuel subsidy removal and harmonising the foreign exchange market rates attracted local and foreign investors to the capital market.”

The Nigerian Economic Summit Group (NESG) said that the market was predominantly driven by domestic investors.

Foreign inflows into Nigerian stocks had jumped more than seven-fold in May last year to ₦27.51 billion, its highest level since December 2021.

This made the market soar on the last two trading days of that month following the announcement of petrol subsidy removal by Tinubu on May 29.

The increase in foreign participation was, however, short-lived, as foreign exchange scarcity lingered in Nigeria.

Nigeria has been grappling with dollar shortage since 2016 when it slipped into its first recession in over two decades.

The recession was induced by the oil price collapse that started in mid-2014 and the sharp decline in the production of the commodity.

Latest capital importation data from the National Bureau of Statistics show that portfolio investment in equities fell to $8.37 million in the third quarter of 2023.

“Despite efforts by the government, anticipated investment has yet to materialise, possibly due to a delayed effect of crucial reforms.

It is important to enhance clarity and transparency in the reform process to bolster investors’ confidence,” the NESG, a private sector-led think tank, said.

Investors Have Low Confidence In Nigerian Market

A renowned economist, Bismarck Rewane, said: “Investor confidence in Nigeria is low primarily due to low sovereign credibility and poor FX market structure.”

“Investment is dependent on the level of confidence in the economy,” he said in a presentation at this month’s edition of the LBS Breakfast Meeting.

You May Also Like: Gains From Conoil, BUA, Dangote Stocks Lift NGX To Reach ₦50trn

“How will investment increase? Build confidence and increase interest rates.”

The Central Bank of Nigeria (CBN) last raised the monetary policy rate in July last year, when its Monetary Policy Committee slightly increased the benchmark interest rate by 25 basis points to 18.75%.

The committee, which has not met since then, is expected to deliver a bumper rate hike next month to keep a lid on inflation, which quickened to 28.92% in December.