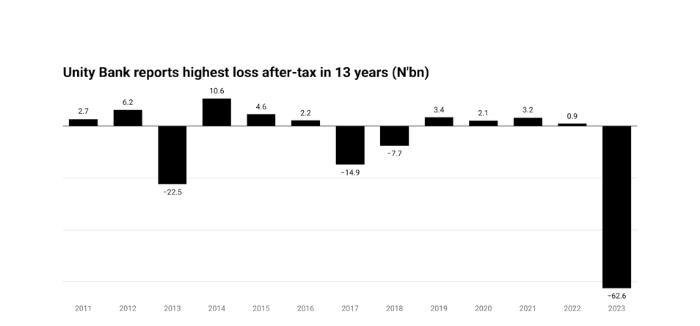

For Unity Bank, survival is no longer just a strategy—it’s an urgent necessity.

The Bank faced its worst financial year in thirteen years, as it reported a ₦62.6 billion loss, a drastic decline from the ₦941.4 million profit it earned in 2022.

Several factors contributed to this downturn, including a ₦50.1 billion net trading loss, which stemmed largely from foreign exchange issues.

Additionally, interest expenses surged to ₦36.2 billion, while operating costs climbed to ₦33.7 billion.

Rising Debt And Declining Asset Quality

At the same time, the bank saw a sharp deterioration in asset quality.

Non-performing loans skyrocketed to 49.17 per cent, a significant jump from 3.62 per cent in 2022.

Meanwhile, Unity Bank incurred a ₦1.7 billion net impairment loss, marking a stark reversal from the ₦1.2 billion write-back it recorded the previous year.

Read Also; Google One Subscription Prices Go Up In Nigeria

A Strategic Merger For Survival

Recognising its financial distress, Unity Bank decided to merge with Providus Bank in 2024, aiming to expand nationally.

This decision came in response to the Central Bank of Nigeria’s (CBN) ₦200 billion recapitalisation requirement for national banks by 2026.

To facilitate the transition, the CBN injected ₦50 billion in financial support and approved a ₦700 billion bailout, linking it directly to the merger.

The Road Ahead

Despite these efforts, Unity Bank’s negative equity deepened to ₦326.9 billion, while its Capital Adequacy Ratio (CAR) plunged to -76.14%, well below the 10% minimum.

Furthermore, total assets shrank to ₦472.6 billion, down from ₦510.1 billion in 2022.

As the recapitalisation deadline approaches, Unity Bank must now navigate a tough road ahead, fighting for survival and financial stability.