By the end of 2024, Nigeria’s pension industry had navigated a year of shifting economic tides, emerging stronger with assets reaching ₦22.5 trillion, according to PenCom.

At the heart of this growth was a deepening reliance on Federal Government of Nigeria (FGN) securities, which continued to dominate pension fund portfolios.

Throughout the year, PFAs actively expanded their Assets Under Management (AUM), which climbed from ₦4.2 trillion in March 2024.

At the same time, pension fund investments in FGN securities rose by 18% year-on-year, reaching ₦14.1 trillion.

Nevertheless, despite this impressive progress, the industry remained underdeveloped, with total pension assets accounting for only 8% of Nigeria’s GDP.

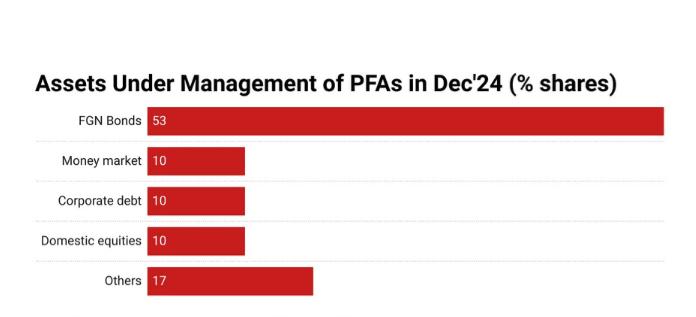

Moreover, FGN Bonds continued to dominate pension fund investments, comprising 53 per cent of total pension AUM.

PFAs further increased their holdings in these bonds by 5 per cent to ₦12 trillion, largely due to regulatory limits and the high-interest rate environment.

Read Also; Google One Subscription Prices Go Up In Nigeria

Additionally, pension fund managers significantly boosted investments in treasury bills, more than tripling their holdings to ₦704.5 billion by the end of the year.

More Funds In Money Markets & Equities

Beyond government securities, PFAs allocated more funds to money market instruments, driving a 33% year-on-year increase to ₦2.2 trillion.

Meanwhile, the domestic equities market thrived, delivering a 37.7% return, which led to a ₦670.7 billion rise in pension AUM tied to equities, bringing the total to ₦2.2 trillion.

Finally, as more individuals joined the pension scheme, the number of pension accounts grew by 4% to 10.6 million.

Consequently, the average RSA balance increased to ₦2.13 million.

With strong investor confidence and regulatory backing, Nigeria’s pension industry continues to expand.

However, further efforts are necessary to unlock its full potential.