Bitt Incorporation a global Fintech Company, has been formally announced as the Central Bank of Nigeria (CBN) Technical Partner for its digital currency, eNaira.

iBrandTV gathered that the eNaira will be unveiled later in the year.

While digital currencies like Bitcoin, Ethereum and Elon Musk’s coveted Dogecoin are relatively popular, central bank digital currencies (CBDCs) are not as well-known.

A digital currency issued by a government works differently from a cryptocurrency like Bitcoin. Cryptocurrencies are not controlled by a singular entity. The creation and distribution of Bitcoin is decentralised meaning anyone can participate.

The question already on Nigerians lip is “If Nigeria is launching its own Bitcoin? Is the Naira going to be as valuable as the dollar? Are we now going to save our Naira on crypto exchanges?”

READ ALSO: Insurer tasks FG on air cargo investment to grow revenue generation

How it operates

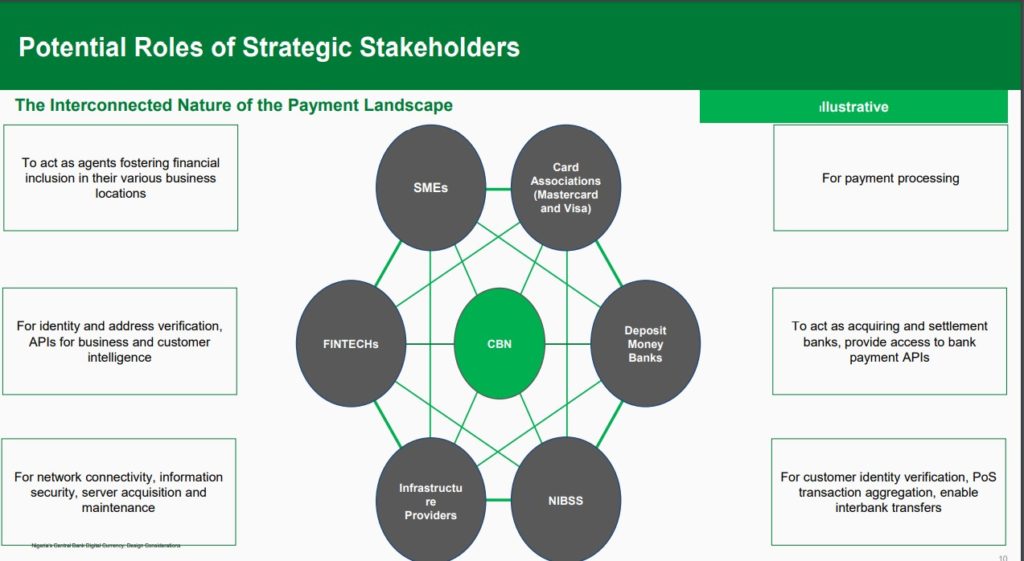

Adedeji Owonibi, founder and COO of Blockchain solutions company stated that, “The interconnected nature of the payment landscape will be maintained, meaning…the deposit money banks and Nigeria Inter-bank Settlement System (NIBSS) will still have a role…fintech companies will also have a role and the central bank will be in the middle.”

This suggests that while the Hyperledger Fabric Blockchain, the Blockchain network selected by the CBN for the eNaira to run on, is permission, the government will grant access to all the parties stated by Owonibi. Nevertheless, it has full control of the system.

Financial institutions will play roles in identity verification, payment processing amongst other things.

Partnership

According to the Central Bank Governor, Mr Godwin Emefiele, the apex bank’s selection of Bitt Inc. from among highly-competitive bidders is hinged on the company’s technological competence, efficiency, platform security, interoperability and implementation experience.

“In choosing Bitt Inc, the CBN relied on the company’s tested and proven digital currency experience, which is already in circulation in several Eastern Caribbean Countries.

“Bitt Inc. was key to the development and successful launch of the central bank’s digital currency (CBDC), pilot of the Eastern Caribbean Central Bank (ECCB), in April 2021,” he said.

Benefits of CBDC

Emefiele listed the benefits of the CBDC to include: Increased cross-border trade, accelerated financial inclusion, cheaper and faster remittance inflows.

Others are easier targeted social interventions, as well as improvements in monetary policy effectiveness, payment systems efficiency, and tax collection.

He added that the CBDC, known as “Project Giant”, had been a long and thorough process for the CBN, with the Bank’s decision to digitize the Naira in 2017, following extensive research and explorations.

“Given the significant explosion in the use of digital payments and the rise in the digital economy, the CBN’s decision follows an unmistakable global trend in which over 85 per cent of Central Banks are now considering adopting digital currencies in their countries,” he said.