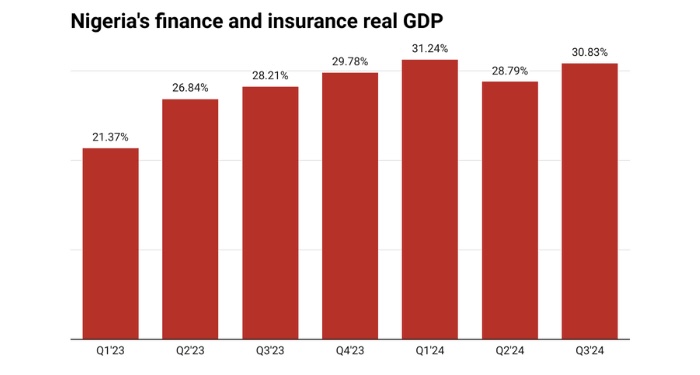

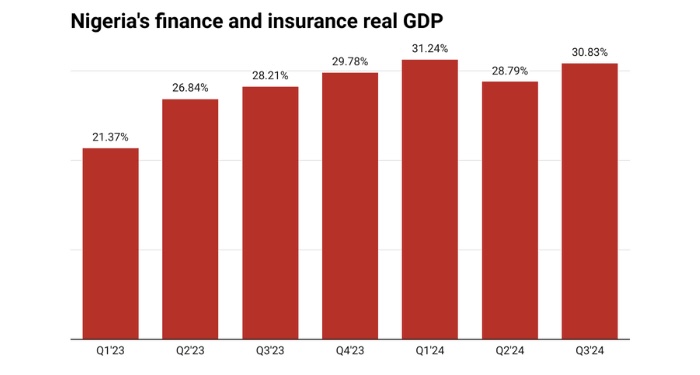

In Q3 2024, Nigeria’s finance and insurance sector grew by 30.83%, spurred by the Central Bank’s interest rate hikes to combat inflation.

While banks have gained from higher lending and investment income, experts caution that prolonged rate increases could impact other sectors.

In the third quarter of 2024, Nigeria’s finance and insurance sector saw a remarkable 30.83 per cent increase in real GDP, driven by the Central Bank of Nigeria’s (CBN) tight monetary policy.

This growth rose by 2.62% points from the same period in 2023 and by 2.04% points from the previous quarter.

The sector, which includes Financial Institutions and Insurance, saw Financial Institutions contribute 91.76 per cent of the sector’s real GDP in Q3 2024.

The sector’s real GDP grew by 5.51 per cent compared to 3.70 per cent in Q3 2023.

Read Also; UK Commits £1.98bn To World Bank For Poverty Alleviation In Low-Income Countries

Experts attribute this growth to the CBN’s aggressive interest rate hikes.

In November, the CBN raised the benchmark rate to 27.50 per cent, marking the sixth hike of the year, to curb inflation.

Banks have benefitted from higher returns on loans and investment securities as a result.

The CBN also liberalised the foreign exchange market in June, weakening the naira and further influencing market conditions.

Despite these challenges, the finance and insurance sector has significantly contributed to GDP growth, creating jobs, improving financial inclusion, and boosting government revenue.

However, economists warn that the long-term effects of sustained interest rate hikes should be carefully monitored, as rising borrowing costs may affect broader economic growth.